What time is the Fed rate cuts meeting today? BTC ▼-0.21% is trading near $116,000 as markets await the Federal Reserve’s September 17 decision. CME FedWatch puts the odds of a 25-basis-point cut at 96%, effectively locking in cheaper capital. The fed rate cut decision will be made at 2:00 PM EST.

The question for the Bitcoin price, however, and crypto is more about impact than timing.

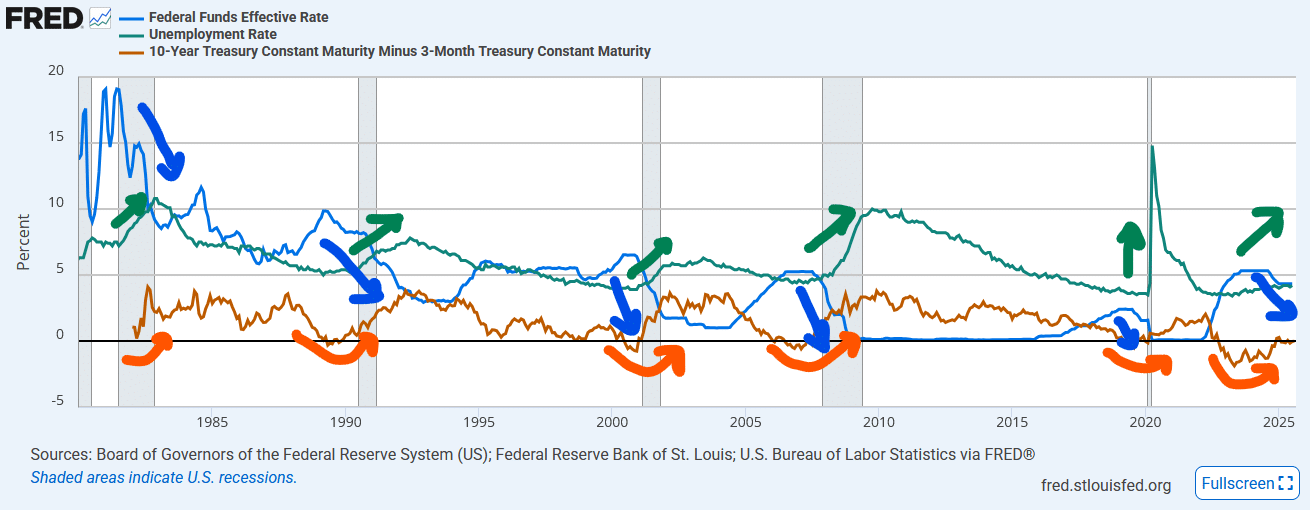

The worry right now is that a recession has followed a majority of rate-cutting cycles, and poor US economic data is ubiquitous leading into the meeting.

Sometimes you get a soft landing (1984, 1995), but they’re rare and only tend to happen if unemployment is falling and yield curves are more normal. Neither is the case today.

While rate cuts are stimulative in a vacuum, the Fed only tends to use them when unemployment worsens or the broader economy is at higher risk than rising inflation is. Jerome Powell and the Fed may have backed themselves into a corner after their excessive COVID stimulus.

Analyst Lark Davis cautioned that liquidity shifts rarely play out cleanly, warning of a potential “sell-the-news” dip before upside momentum takes hold. Conversely, trader Sykodelic drew parallels to 2024, when Bitcoin climbed 77% in the three months after a 50 bps cut, calling the current setup “nearly identical.” So, where does crypto go next?

Volatility First, Rally Later?

Order book data shows heavy bids stacked under $115,000, raising the chance of a liquidity sweep before bulls defend the level. Spot markets are sending mixed signals, with BTC ETF inflows hitting $2.3 billion last week, according to Farside Investors, but futures open interest and funding suggest traders remain hesitant.

Deine tägliche Dosis #Bitcoin ETF Einblicke.

[16.09.2025]

Die positiven Flows setzen sich fort: Gestern gab es 292,3 Millionen US-Dollar an Zuflüssen bei den BTC-ETFs. Einige wichtige Details stachen hervor.

1) BlackRock: BlackRock verzeichnete Zuflüsse in Höhe von 209,2… pic.twitter.com/09gYGTCiui

— AlphaDōjō (@alphadojo_net) September 17, 2025

Analysts broadly expect turbulence around the announcement, with some investors ready to buy dips if Bitcoin tests support. Altcoins may follow the same path, with liquidity rotation into smaller tokens if BTC holds ground above $112K.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Fed’s “Third Mandate” Raises Bigger Questions

Beyond the immediate cut, policy watchers are dissecting a new Trump-Fed development. Trump’s Fed pick Stephen Miran has revived a little-known “third mandate” buried in the Federal Reserve Act, which is to moderate long-term interest rates. While long ignored, the clause could be used to justify yield curve control or expanded bond-buying.

Former BitMex Co-founder Arthur Hayes suggested that yield curve control could push Bitcoin toward $1 million. With U.S. debt topping $37.5 trillion, sustained low rates may become not just a policy preference but a political necessity.

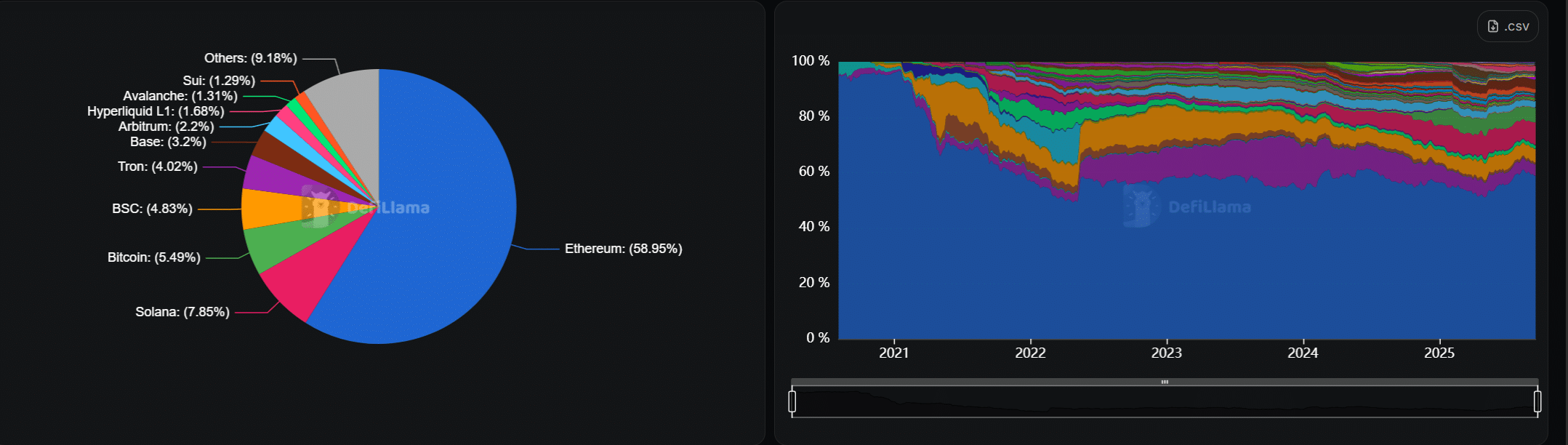

DeFiLlama data places the total crypto market cap near $4.1 trillion, just shy of last month’s highs. If Bitcoin reclaims $116,000 and ETF flows remain strong, 99Bitcoins analysts believe fresh all-time highs could follow. But if Powell signals restraint, BTC risks being trapped in the $107 -$115K range.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

What’s Next for Crypto Investors?

Near term, traders expect turbulence around the Fed, with dip-buying opportunities and room for altcoin flows if Bitcoin breaks higher.

The longer horizon, however, will feature ongoing fights over the Fed’s role, and the prospect of Trump allies rewriting its mandate.

Bitcoin may not get a straight line to $120K, but with Wall Street and Washington both playing roles, the stakes have rarely been higher.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- The BTC price is trading near $116,000 as markets await the Federal Reserve’s September 17 decision.

- Bitcoin may not get a straight line to $120K, but with Wall Street and Washington both playing roles, the stakes have rarely been higher.

The post What Time is The Fed Rate Cut Meeting Today? Fed Rate Cuts Looms As Bitcoin Traders Brace for $112K Whiplash appeared first on 99Bitcoins.