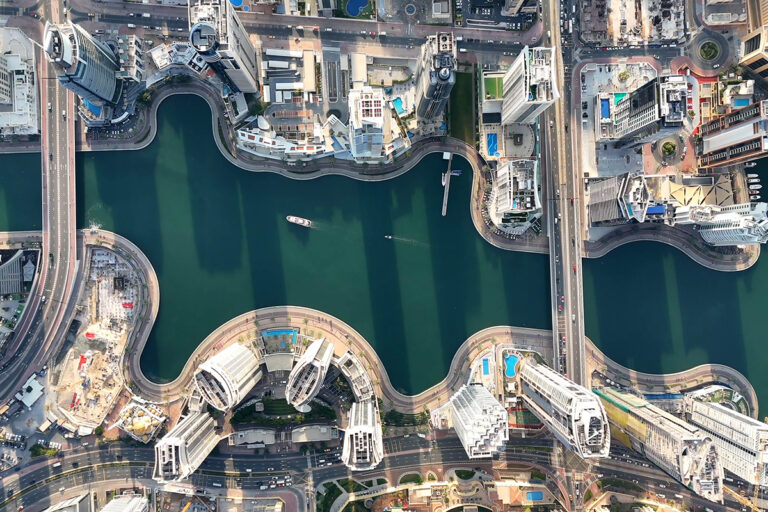

The UAE real estate market continued its robust growth in the third quarter of 2025, with strong performance across commercial, residential, hospitality, and industrial sectors, according to CBRE Middle East’s UAE Real Estate Market Review.

Despite limited new supply, the market demonstrated resilience amid rising foreign direct investment, non-oil growth, and record tourism numbers, positioning the UAE as one of the world’s most stable and competitive economies.

CBRE noted that the UAE’s GDP is projected to expand 4.9 per cent in 2025, supported by stronger oil production and a 4.6 per cent non-oil growth rate, while the Purchasing Managers’ Index (PMI) rose to 54.2 in September, signalling sustained expansion and investor confidence.

Residential: Dubai defies seasonal trends as sales pass $38bn

Dubai’s residential sector recorded 56,723 transactions worth AED139.8bn ($38.1bn) in Q3 — up 16 per cent year-on-year. Off-plan sales dominated, accounting for 75 per cent of all deals, while prices rose 12.9 per cent.

The strongest annual growth was observed in Dubai Silicon Oasis and DIFC, underscoring demand across both established and emerging communities.

In Abu Dhabi, transaction volumes reached a record 6,610 in Q3, a 79 per cent year-on-year increase, with both prices and rents surging over 25 per cent amid tight supply and robust demand.

Commercial sector: High occupancy and landlord-friendly dynamics

Dubai’s office market remains significantly undersupplied, with average occupancy reaching 94 per cent and rents rising 19 per cent year-on-year. Demand in key free zones — including DIFC, Dubai Design District (d3), and DMCC — continues to outpace supply, prompting occupiers to pursue early pre-leasing and developers to accelerate construction pipelines.

In Abu Dhabi, the rise of Abu Dhabi Global Market (ADGM) has driven near-full occupancy on Al Maryah Island, where average rents rose 8 per cent year-on-year and prime offices command substantial premiums.

With remaining availability limited mainly to Reem Island, occupancy there has surged over the past year as businesses linked to ADGM seek nearby space.

Matthew Green, Head of Research MENA CBRE, said: “The residential development pipeline continues to grow, with rising deliveries now starting to soften rental sector dynamics across some locations.

“However, commercial markets remain heavily supply constrained, and without significant handovers until 2027 at the earliest, the current landlord-friendly market looks set to continue.”

UAE hospitality: record visitor numbers and rising hotel revenues

The UAE’s hospitality sector maintained strong momentum, with the country on track to welcome 27.6m international visitors in 2025.

Both Dubai and Abu Dhabi reported year-to-date occupancy rates of 79 per cent, while revenue per available room (RevPAR) rose 12 per cent year-on-year.

Abu Dhabi’s hotel revenues surged 19 per cent to AED4.8bn ($1.31bn), while Ras Al Khaimah saw total hospitality revenues increase 9 per cent, supported by new resort openings and continued domestic travel demand.

Retail and industrial: constrained supply, sustained demand

Retail assets across Dubai and Abu Dhabi remain near full occupancy, at 97 per cent and 95 per cent respectively. Rents rose 5.3 per cent in Dubai and 3.3 per cent in Abu Dhabi, driven by population growth and tourism-related spending.

Prime space availability remains limited, with new international entrants such as Skims and Ulta Beauty opening at Mall of the Emirates, replacing outgoing tenants as part of active asset management strategies.

The UAE’s industrial sector continues to experience strong expansion, with average rents rising 18 per cent in Dubai and 12 per cent in Abu Dhabi. Large-scale logistics and manufacturing facilities are under construction, with new completions expected to begin in 2026.

Economic outlook: sustained growth, strategic diversification

CBRE’s report highlights that the UAE’s economy remains on a solid growth trajectory, supported by strategic diversification, stable energy revenues, and investor-friendly policies.

The combination of strong tourism, record occupancy, expanding industrial activity, and limited commercial supply reinforces the UAE’s position as a leading global destination for business and investment.