Are you too late to get Solana before it pops off in October when the ETF money comes in? It feels like $205 is still a decent price. In this article, we’ll examine the current Solana price graph and provide an update.

SOL ▲5.55% has approved one of the most ambitious upgrades in its history.

After a two-week governance process, more than 98% of validators voted to adopt the Alpenglow consensus protocol, with 52% of the total stake participating. The upgrade is expected to slash transaction finality from over 12 seconds to just 150 milliseconds, a speed more comparable to Web2 systems than today’s blockchains.

The Solana Foundation called the change “a step toward financial infrastructure that operates at internet speed,” arguing that Alpenglow could unlock new use cases requiring responsiveness and cryptographic certainty. So, will the Solana price follow?

Solana Price Graph: What the Alpenglow Upgrade Means for the SOL Price

Alpenglow replaces two of Solana’s core consensus tools:

- Votor will replace TowerBFT, reducing finality times to sub-second levels.

- Rotor will replace proof-of-history timestamping, accelerating validator communication.

JUST IN: Alpenglow, the most significant consensus upgrade proposal in @Solana's history, aiming for 150ms block finality, has passed governance. 98.27% voted 'Yes', 1.05% voted 'No', with 52% of the Network stake participating. pic.twitter.com/T2IbPW0UeT

— SolanaFloor (@SolanaFloor) September 2, 2025

If successful, these changes could make Solana uniquely positioned for high-frequency DeFi, payments, and even institutional trading platforms. As it stands, several Solana devs claim this will make SOL more of a Web2-like user experience, but with Layer-1 security guarantees.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

SOL Price Analysis: Can SOL Hold the $200 Level?

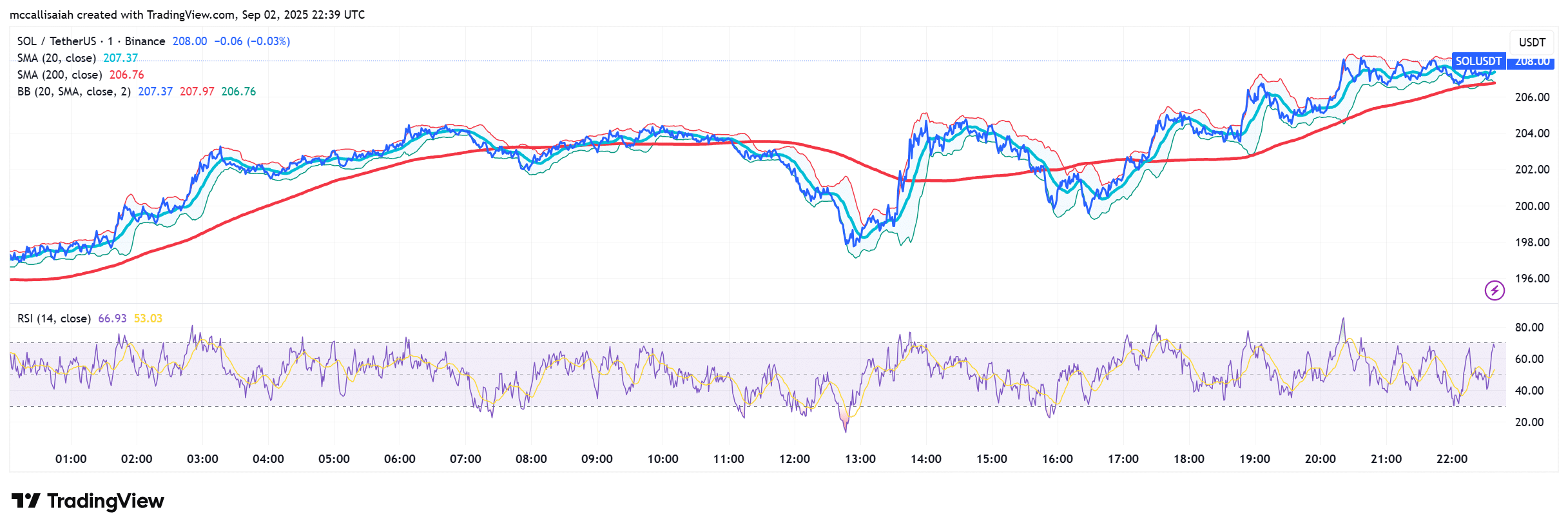

SOL price trades at $207.21, up +5.4% daily, with market cap back above $90Bn.

The chart shapes into a cup and handle formation with a rounded base up from $202 to $208 (cup) followed by a shallow pullback (handle). Resistance remains heavy at $205–$207 yet volume increased on the rally, adding weight to the move. A fresh surge in buy volume will be key for breaking through $209 resistance.

Moreover, the Solana price has other bullish factors:

- Exchange reserves spiked in late August, suggesting profit-taking.

- SOL whales are accumulating aggressively in the $185–$190 zone, hinting at defense if prices correct.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Institutional Drivers for Solana Price: ETFs, Policy, and Long-Term Growth

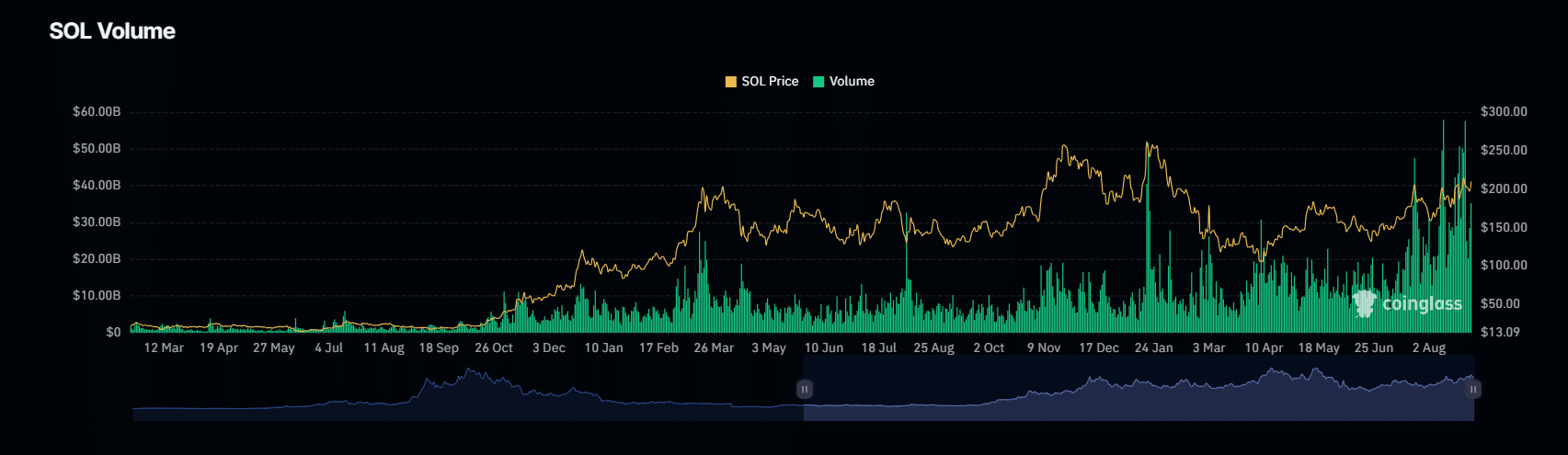

Speculation around ETFs continues to buoy the market. Among the filings on the table is the Solana REX-Osprey SOL + Staking ETF (SSK), with no clear read on when regulators might decide. If history is anything to go buy then know that Solana has ended September higher in four of the last five years.

If Solana is able to maintain its price from now until October, we are most certainly looking towards new all time highs for the SOL price by year’s end.

EXPLORE: Is Binance Safu? North Korea Just Stole $13.5M in XVS Crypto Heist

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- US manufacturing is saved! Or at least that’s what crypto investors hope as markets brace for a pivotal day and fresh manufacturing PMI data

- According to Polymarket, markets expect two 25-basis-point rate cuts in 2025, likely in September and December

The post Solana Price Prediction After Alpenglow Upgrade: Is $300 the Next Target for SOL? appeared first on 99Bitcoins.