Shares of Electronic Arts (EA), the videogame giant, jumped nearly 15 per cent in Friday’s trading after Wall Street Journal reported that Saudi’s Public Investment Fund (PIF) was among a group of investors planning to take the company private in a US$50 billion deal that is likely to be the largest leveraged buyout of all time.

The WSJ said apart from PIF, which is known to have invested massively in the gaming industry, the group of investors includes private-equity firm Silver Lake, and Jared Kushner’s investment firm Affinity Partners. The newspaper quoted sources, who wished to remain anonymous, saying a deal could be unveiled as soon as next week.

The company had a market value of around US$43 billion after Thursday’s close, but with its share reaching a record high of US$193.35 on Friday, its market value increased to around US$48 billion.

According to PIF’s disclosure with the US Securities and Exchange Commission (SEC) following the second quarter of 2025, the Saudi sovereign fund already held 24.8 million shares in EA, which would be roughly 10 per cent stake, valued at US$4.8 billion after Friday’s close.

PIF is also a significant investor in rival videogame maker Take-Two Interactive, holding 11.4 million shares, or a 6.5 percent stake in the company. Take-Two stock also went up by 4.49 per cent to US$256.12 after the announcement, valuing PIF’s stake at US$2.92 billion.

In January 2022, PIF launched Savvy Gaming Group (SGG) with the aim of becoming the leading games and esports group domestically and internationally. At that point, the company announced it had acquired ESL, a leading global organiser of entertainment and esports events, and FACEIT, a top digital esports platform. It later acquired California-based Scopely in 2023 for US$4.9 billion.

The WSJ added that assuming a deal comes together, it is likely to rank as the largest leveraged buyout ever, not adjusting for inflation. The largest to date was the 2007 purchase of Texas utility by a group of private-equity firms for around US$32 billion, which doesn’t include assumed debt.

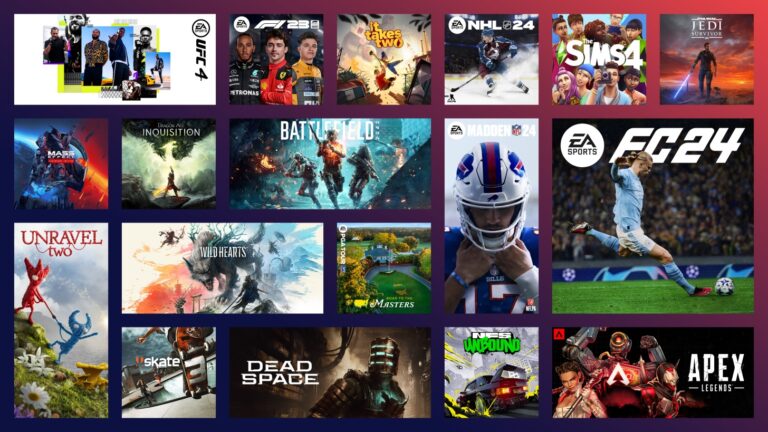

EA has some of the best-selling videogame titles in its portfolio, including EA Sports FC (FIFA), which has sold over 325 million units; The Sims, with more than 200 million units sold; Need for Speed; Battlefield; Medal of Honor; NBA Live and Star Wars: Battlefront.

The company is planning to launch ‘Battlefield 6’, the latest edition of its popular game franchise on October 10. It also launched FC 26 worldwide yesterday (Friday).