U.K.-based fintech Tide has entered the unicorn club with a fresh funding of $120 million led by TPG, as the startup now serves over 1.6 million micro and small enterprises globally — with more than half of them based in India, the company’s largest and fastest-growing market.

The new round — a mix of primary and secondary investment, though the startup declined to confirm the exact split — values the eight-year-old startup at $1.5 billion. It includes share sales by employees, early angels, and a few minority investors. TPG backed the round through its multi-sector impact vehicle, The Rise Fund, which has invested in over 85 mission-driven companies. Existing investor, the Apax Digital Funds, also participated.

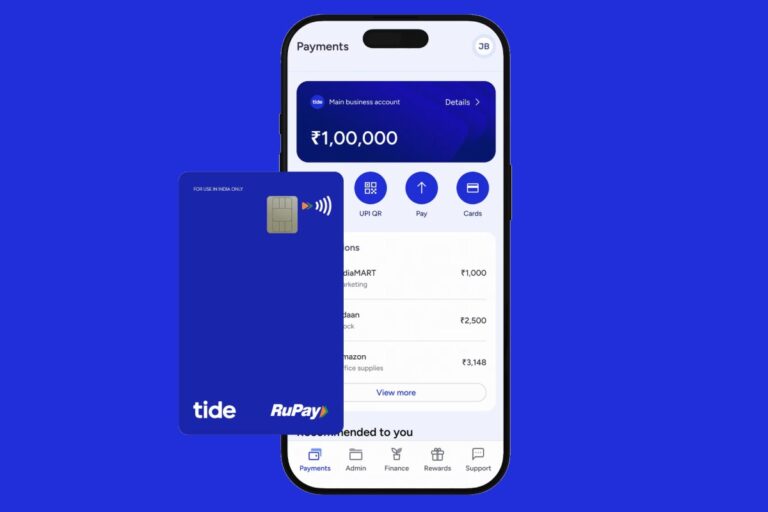

Globally, micro and small enterprises, including contractors, freelancers, and solopreneurs, spend a significant amount of time on business management tasks like accounting, invoicing, taxes, securing loans, and managing payments and expenses. While traditional banks and fintech startups offer services to this segment, most solutions are not purpose-built for their unique needs. Tide aims to change that with its unified business platform, offering tailored tools such as accounting integrations, invoicing, business loans, asset finance, payroll, expense cards, and even company registration.

Initially launched in the U.K. in 2017, Tide expanded into India in December 2022 to tap into the country’s vast base of small enterprises — around 60 million micro and small businesses employing over 250 million people, per the recent Indian government data. Since its entry, Tide has onboarded more than 800,000 Indian businesses, which it refers to as “members” — surpassing its U.K. member base of nearly 800,000. In the U.K., where Tide is already profitable, the company serves around 14% of the country’s small and medium business market.

“There is a huge trend to formalization. So, our biggest enemy is cash, and not any competitors,” said Oliver Prill, CEO of Tide, in an interview.

“In India, there’s a debate, as the growth rate slowed a little bit, but it’s still a hugely impressive growth rate. You look at continental Europe or the U.K., the growth rate is a lot less,” he told TechCrunch.

Tide estimates that around four million micro and small businesses are launched in India every year. These businesses typically seek support in areas like accessing formal credit, accepting Indian government-backed Unified Payments Interface (UPI) for payments, and navigating the country’s indirect tax system, the Goods and Services Tax. Tide serves them through its digital platform, available as an app on both iOS and Android.

Techcrunch event

San Francisco

|

October 27-29, 2025

The U.K. startup expects to onboard one million businesses in India by the end of this year and is already seeing strong demand from tier-3 cities and beyond (referring to smaller, less urbanized towns with limited digital and financial infrastructure), Gurjodhpal Singh, CEO of Tide India, told TechCrunch.

In India, Tide works with around 25 lenders on its platform to facilitate credit for small businesses, recommending partners based on each business’s needs. The company also offers services such as fixed deposits, bill payments, bank transfers, and cash withdrawals through ATMs.

In addition to the U.K. and India, Tide launched in Germany in May 2024 and expanded into France earlier this month. The startup offers a tailored experience in each market, including local language support.

With the fresh funding, Tide plans to expand further geographically, enhance its product, and invest in agentic AI.

The startup covers a range of finance and admin services already, but there are still some gaps to fill. “In the next few months and quarters, you’ll see some major developments in that area,” Prill said, referring to upcoming product launches enabled by the latest funding round.

Tide currently employs over 2,500 people across its global operations.