Hamish Blake been looking for something to do after losing his job as a Hubbl brand ambassador.

And the comedian’s next big idea is already worth more than $1 billion according to Airtasker CEO Tim Fung.

Blake has launched a site called “Hametasker” offering to do jobs for people.

“We are looking for people who need a high quality job done for their home, community group or business,” it says.

“Whether it’s construction, catering, farm work, event planning, business operations, a wedding cake, mechanical repairs, dress making, whatever! – If you require a skilled person we are here… if you were going to post a task on an online platform like Airtasker from a couple hundred dollars up to say $5,000, then fill out the details.”

But there may be an ulterior motive involved, since the caveat to “you could get a great job done cheaply” is that “you just have to be ok with us filming it”.

ASX-listed Airtasker (ASX:ART), founded in 2012, went public in 2021, with cofounder Tim Fung still at the helm. The odd jobs marketplace is due to report its half-yearly results next week.

After spotting Blake touting for tasks on social media, the Airtasker team returned fire on Wednesday this week, posting a team member walking through Sydney with a sign saying “Hey Hamish, looking for a side hustle? We’ve got you!” before standing outside Listnr, where Blake hosts a podcast.

Airtasker’s Instagram post said “Hey @hamishblakeshotz, we’ve got plenty of tasks (55k+) that people need done and we think you’d make a great Tasker” (the company’s term for people who take on Airtasker jobs).

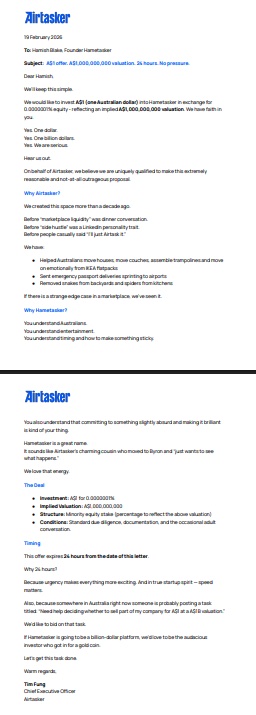

Fung then took things further, writing to Blake saying he wants to invest in Hametasker.

$1 you can’t refuse

The rival CEO is prepared to stump up $1 in Hametasker at a $1 billion valuation, making the startup a unicorn before it’s even generated revenue – or started filming.

“We believe we are uniquely qualified to make this extremely reasonable and not-at-all outrageous proposal,” Fung wrote.

“We created this space more than a decade ago. Before ‘marketplace liquidity’ was dinner conversation. Before ‘side hustle’ was a LinkedIn personality trait. Before people casually said ‘I’ll just Airtask it’.”

Fung said he believed in Blake’s vision because “You understand Australians. You understand entertainment. You understand timing and how to make something sticky.”

Byron Airtasker

He also complimented Blake on his company’s name, saying “It sounds like Airtasker’s charming cousin who moved to Byron and ‘just wants to see what happens.’ We love that energy.”

Fung also bought some startup hustle to the deal, saying it’s on the table for just 24 hours.

“Because somewhere in Australia right now someone is probably posting a task titled: ‘Need help deciding whether to sell part of my company for A$1 at a A$1B valuation’,” he wrote to Blake.

“We’d like to bid on that task. If Hametasker is going to be a billion-dollar platform, we’d love to be the audacious

investor who got in for a gold coin. Let’s get this task done.”

Fung has yet to receive a response,. The Airtasker CEO, who knows startup life well and has also ridden public market sentiment when it comes to his company’s share price, says he wanted to poke fun at software and technology valuations “that don’t really reflect the reality” amid investor hype around AI and claims that “software is dead” – something that’s also hit the share price of Nasdaq-listed Australia unicorn Atlassian, which has seen a two-thirds drop in its valuation over the past 12 months.

“Smart investors looking through the hype to score some value at this point in the cycle,” Fung told Startup Daily, referring to software companies.

“When it comes to AI, there’s some exuberance where the valuations are probably not really representative either.”

Airtasker’s share price has fallen by nearly 32% since September 2025 and now sits a $0.26 cents for a market cap of $124 million.

Perhaps Fung is also hoping to score an investment bargain by tipping $1 into Hametasker.

If Blake’s startup was called Hametasker.ai, it could potentially be valued at $10 billion or more, with VCs throwing term sheets at it like Americans throwing dildos at ICE convoys.