In August, Ethereum crypto is up a massive 40%. This surge is unprecedented. At this pace, ETH USD is not only inches from break above 2021 highs but ETH crypto can easily soar to as high as $5,000 in Q3 2025. Considering all bullish events around ETHUSDT, it came as a surprise that data shows massive unstaking of previously locked ETH across different liquid staking platforms, including Lido.

Latest reports shared on X show that a record 761,000 ETH worth north of $3.6 billion at spot rates has flooded the unstaking queue. Interestingly, the urgency to unstake ETH coincides with the pullback in prices, impacting some of the top Solana meme coins.

1/ Record number of $ETH is in the unstaking queue:

671k $ETH = $3.2B USD

What's more, queue wait time reached record of ~12 days.

Why is it happening? A few reasons: pic.twitter.com/W2dAXXxome

— Ignas | DeFi (@DefiIgnas) August 14, 2025

ETH USD Falls From $4,750

From the ETH USD daily chart, prices fell from around $4,750 to below $4,500.

Coinciding with this drop is a spike in trading volume, pointing to possible sellers standing their position, capping gains. Technically, a close above $4,800 is precisely what’s needed for ETH ▼-2.13% crypto to spike to as high as $5,000, printing a fresh all-time high.

However, should sellers take over today, a close below $4,440 may see ETH reverse gains, with the next stop being $4,000. It is a psychological support, marking previous resistance that capped ETH bulls in July 2025.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Race to Unstake Ethereum, What’s Going On?

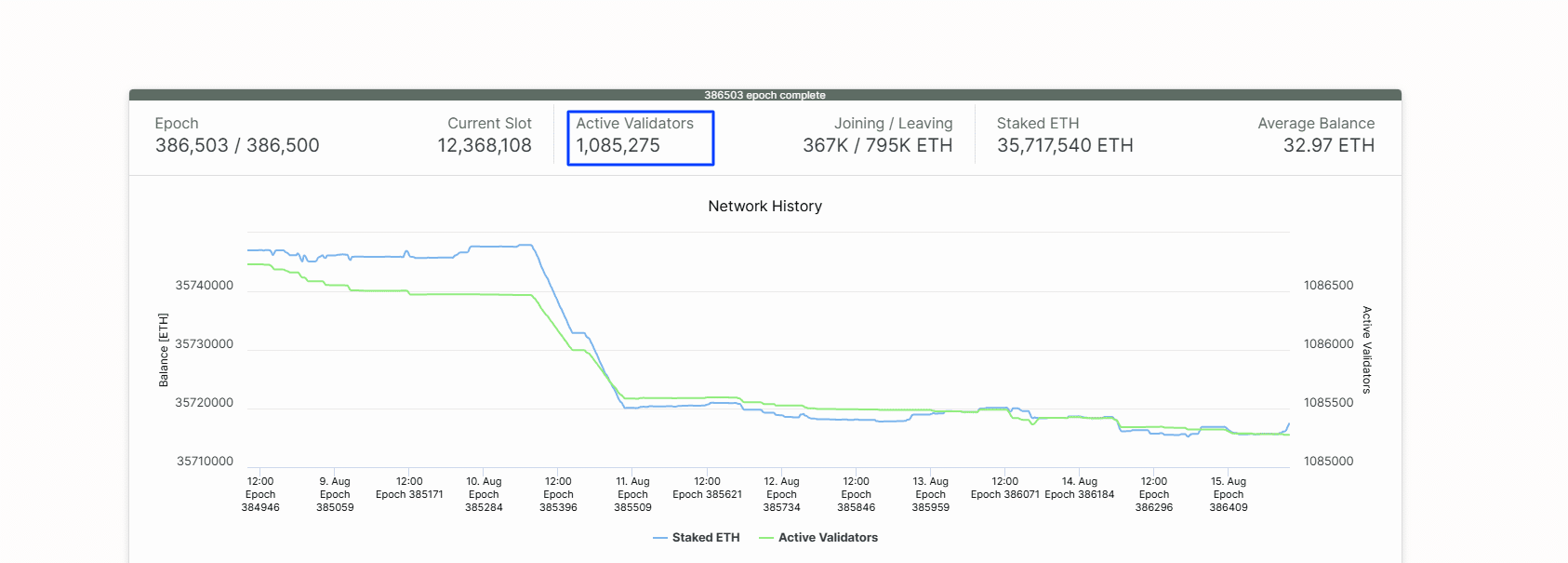

Considering the state of ETHUSDT price action, the move by unstake could accelerate the sell-off. Being a proof-of-stake network, Ethereum relies on validators. There are over 1 million validators who have, on average, locked over 32 ETH, helping secure Ethereum and in return, earn block rewards and fees.

(Source: Beachocha.in)

Though at least 32 ETH is needed to run a validator node in Ethereum, there are other providers, including Lido Finance and Rocket Pool, that pool ETH from holders and stake them on the network before distributing rewards.

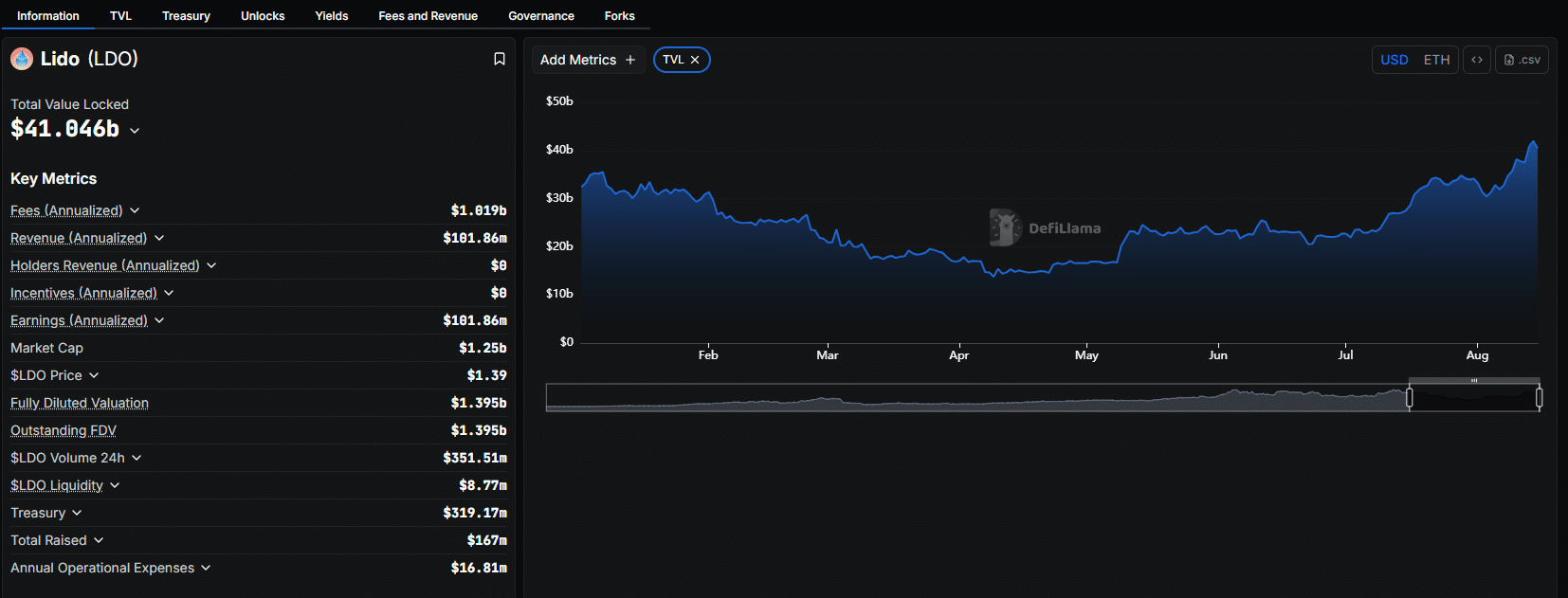

As of August 15, Lido Finance, one of the liquid staking platform, is among the largest DeFi protocol. According to DefiLlama, the protocol manages over $41 billion of assets, mostly ETH.

(Source: DefiLlama)

It is now emerging that there is an urgency among ETH holders to unlock their coins from the network, mostly via liquid staking platforms, including Lido Finance.

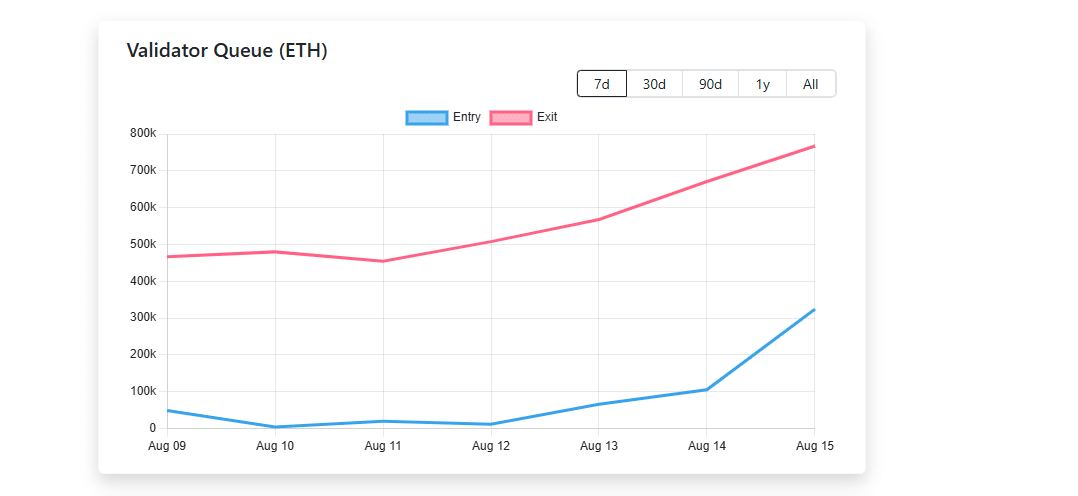

In a matter of days, the exit queue has increased from less than 2,000 ETH to over 760,000 ETH. As a result of this explosion, Ethereum’s exit mechanism, which limits validator exits per epoch.

(Source: Validator Queue)

Before this spike, it took roughly 6.4 minutes for a withdrawal to be processed. It now takes over 12 minutes, demonstrating the strain Ethereum is facing that risks destabilizing the network.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Are Holders Taking Profits?

Naturally, the question is: What’s all the rush to withdraw? Considering this wave, industry experts are convinced that ETH holders are keen on taking profits and cashing in on the rally.

ETH has, for month, underperformed versus Bitcoin and other best cryptos to buy, including Solana and Cardano in previous bull cycles.

With ETH USD prices booming, those who HODL ETH see this as a chance to lock in profits. Provided prices remain above $4,000, there is a strong incentive to realize gains.

DISCOVER: 20+ Next Crypto to Explode in 2025

Blame Aave?

There is also another possibility that DeFi investors, especially on lending protocols like Aave, are deleveraging.

Galaxy Digital notes that from mid-July, ETH borrow rates on decentralized money markets, mostly Aave, rose from less than 3% to over 18% in matter of days.

As a result, users who wanted to borrow ETH and restake them had no economic incentive to do so because the borrow rate was high yet ETH mainnet yields were lower.

Because this loophole was sealed, it triggered a cascade of ETH position unwinds, impacting even Justin Sun who had to withdraw $600 million worth of ETH from Aave.

For now, Aave ETH borrow rates have stabilized below 3% but it hasn’t stopped validators from unstaking.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Ethereum Validators Unstake Over $3 Billion, ETH USD Falls

- Ethereum holders scrambling to unstake

- ETH USD drops from $4,750

- Urgency to unstake could be due to profit taking

- Experts also point to possible DeFi deleveraging

The post Ethereum Validators Unstake Over $3.6 Billion, ETH USD Falls: What’s Going On? appeared first on 99Bitcoins.