Tether is rolling out USAT, a US-compliant stablecoin built to meet the rules of the new GENIUS Act. Unlike USDT, where only about 80% of reserves meet compliance standards, USAT will keep assets with Anchorage Digital. JPMorgan analysts led by Nikolaos Panigirtzoglou said the launch, alongside Hyperliquid’s USDH and other fintech coins, will pressure Circle.

This shift could lift margins and avoid missteps like Circle’s exposure to Silicon Valley Bank in 2023.

JPMorgan noted that the fight for market share is zero-sum mainly unless the overall crypto market grows. So, who will win the stablecoin wars?

Can Hyperliquid and Fintech Giants Really Steal Market Share From Circle?

Hyperliquid, one of the most viral Web3 projects of 2025, is moving to cut ties with Circle’s USDC dependency by rolling out its own USDH stablecoin. 99Bitcoins analysts noted Hyperliquid accounts for around 7.5% of total USDC usage, which could translate into an immediate hit to Circle’s market share.

We wondered how Circle was going to react to the $USDH saga and in answer, they released a blog post discussing:

1⃣ Buying $HYPE & continuing to buy more

2⃣ Being a validator

3⃣ Investing in developer tooling along w/CCTP v2

4⃣ Incentive programs for HIP-3/HyperEVM builders pic.twitter.com/roJvZUPvm7

— Castle Labs

(@castle_labs) September 18, 2025

Meanwhile, Robinhood and Revolut are rumored to develop in-house stablecoins, adding another threat to Circle’s strategy of building Arc, a blockchain optimized for speed and interoperability to keep USDC central in the ecosystem.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Why Has Stablecoin Growth Stalled Despite All the Hype?

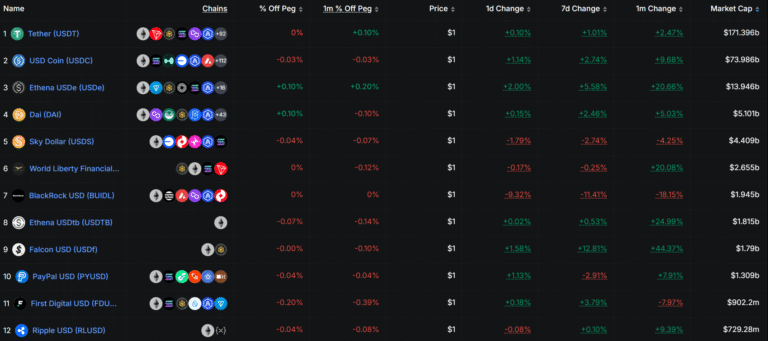

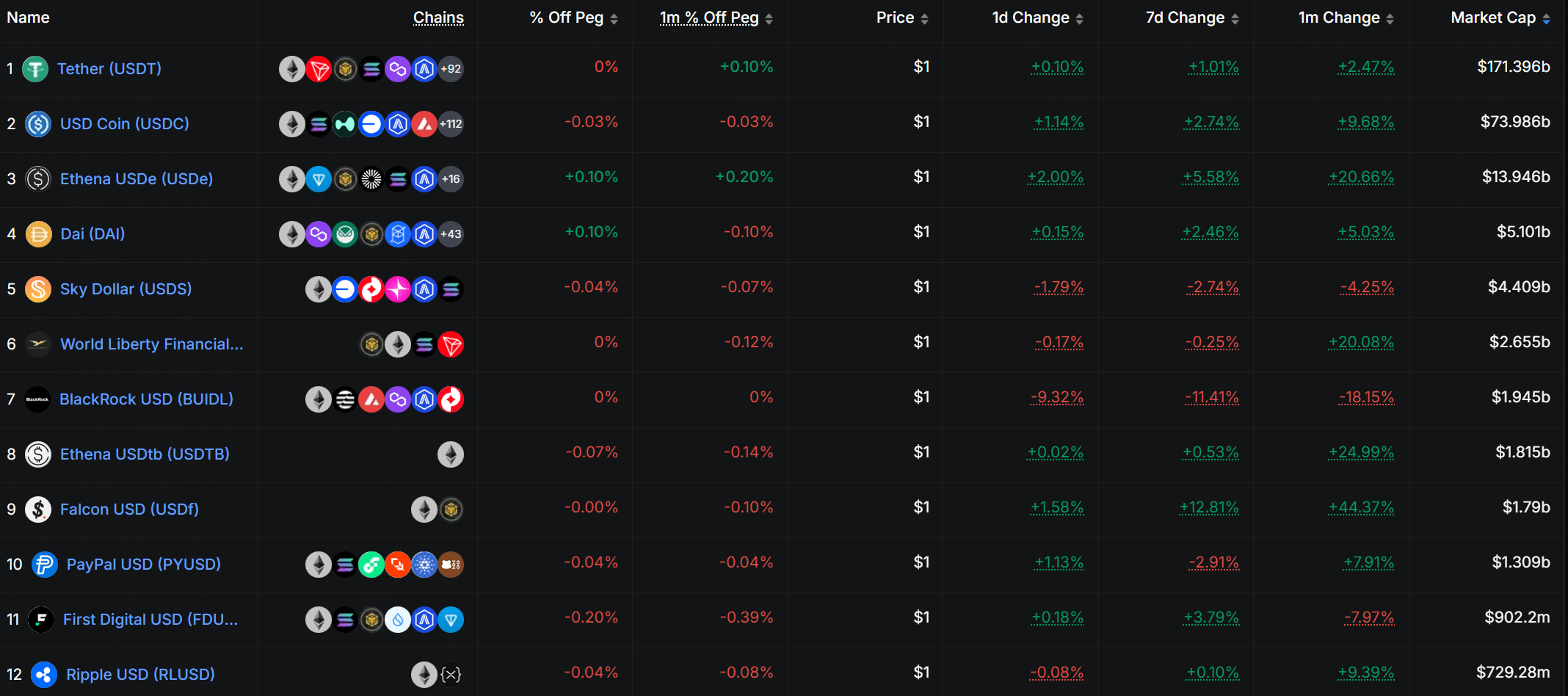

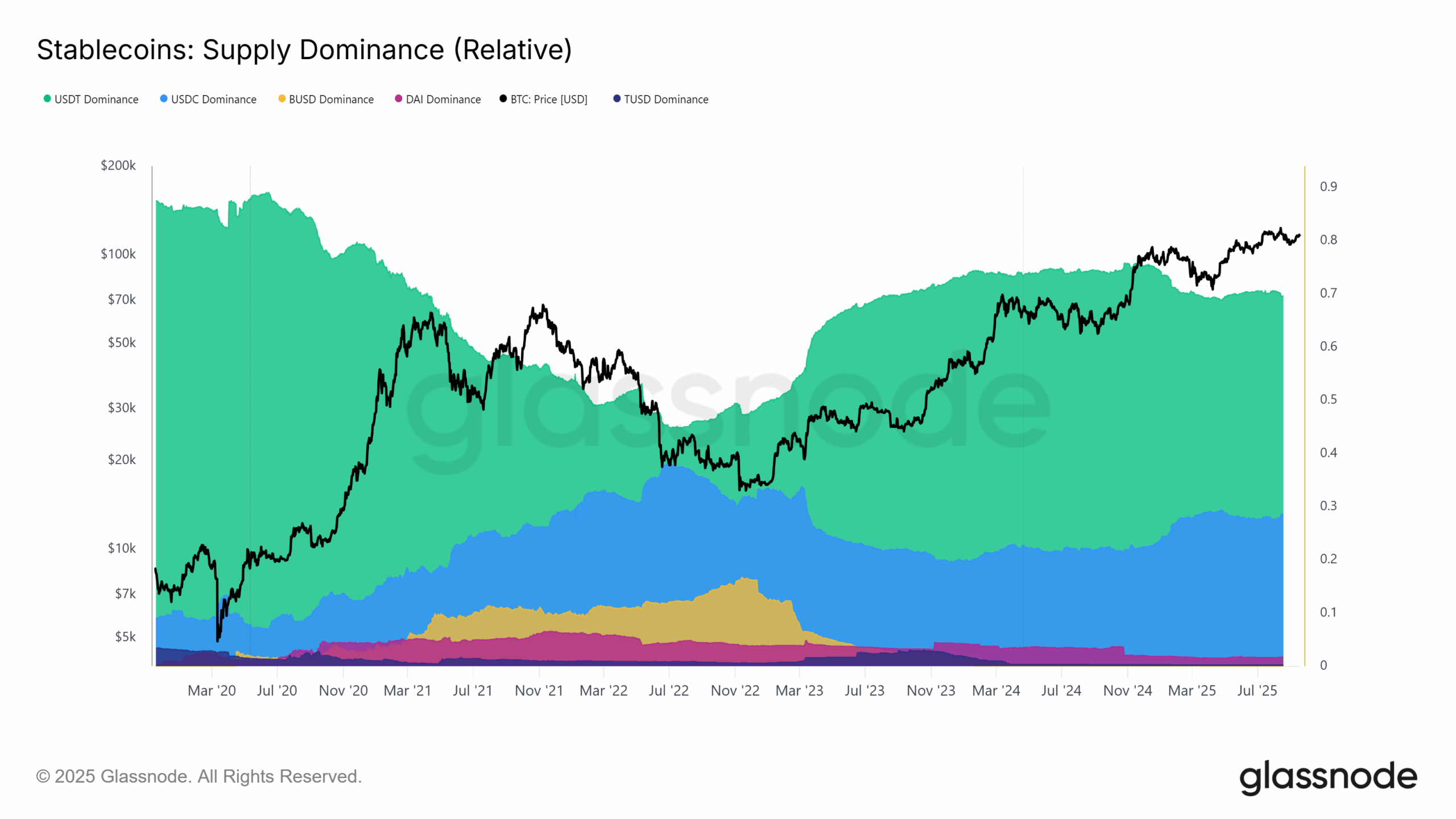

According to DeFi Llama and CoinGecko data, the total stablecoin market currently sits at roughly $290 Bn. That sounds massive, but zoom out and the story changes:

- Stablecoins represent under 8% of the total crypto market cap, a level that has barely moved since 2020.

- Supply growth has mirrored the broader crypto market, not surged ahead of it.

Glassnode metrics show stablecoin velocity slowly increasing, indicating a lack of fresh demand entering the system.

This stagnation is why JPMorgan warns that the stablecoin market may not grow meaningfully unless the entire crypto industry expands, leaving issuers to fight for slices of the same pie.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

What Does This Battle Mean for Stocks, Energy, and the Economy

The role of stablecoins has widened, touching everything from fintech business models to banking policy and commodity trade.

On the macro side, stablecoins could be used in cross-border settlements for commodities like oil or natural gas. That could ripple into energy pricing if adoption widens. But the key uncertainty remains of which stablecoins are going to dominate the market? Moreover, is it a zero-sum game like JPMorgan warns or is that just FUD?

EXPLORE: Singapore Denies Do Kwon’s $14M Refund Demand For ‘Stolen’ Penthouse

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- JPMorgan analysts led by Nikolaos Panigirtzoglou said the launch, alongside Hyperliquid’s USDH and other fintech coins, will pressure Circle.

- Is the stablecoin market a zero-sum game like JPMorgan warns, or is that just FUD?

The post Did JPMorgan Just Back Hyperliquid Over Circle For Future of Finance? appeared first on 99Bitcoins.