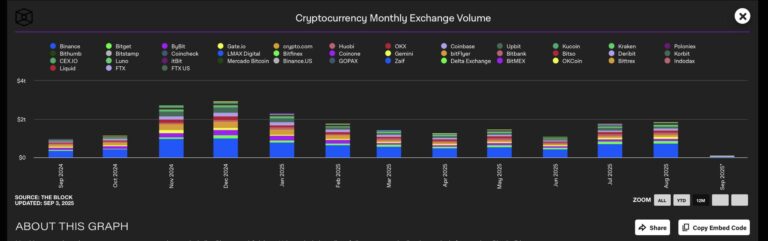

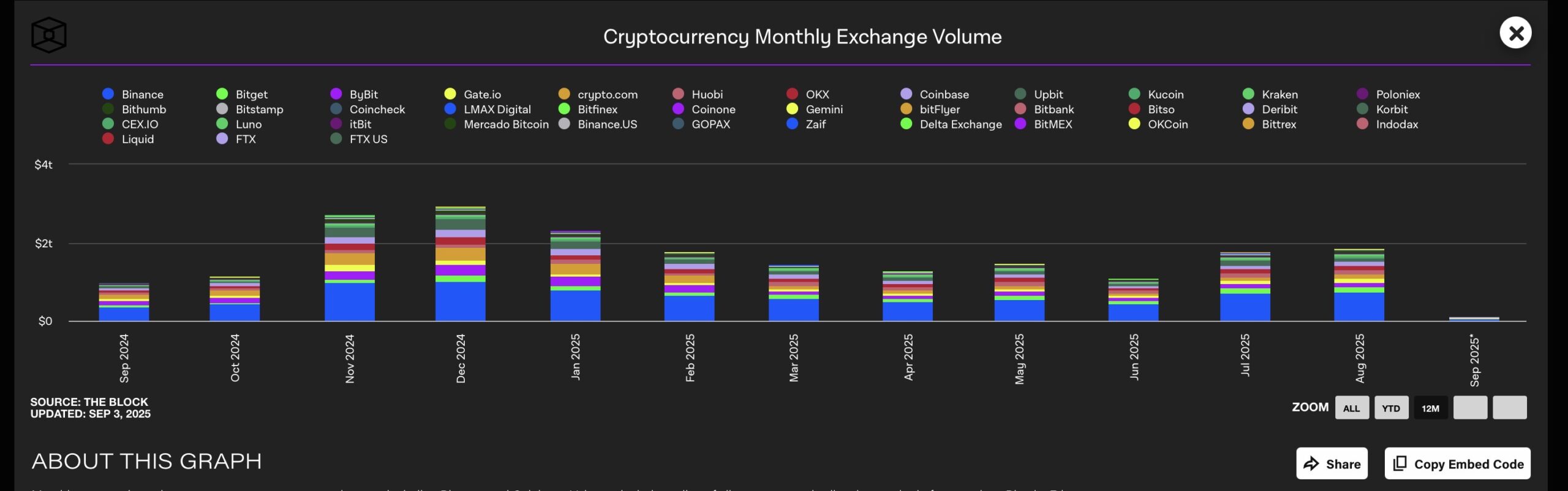

The crypto market closed August with its most active month since January, as spot trading volumes climbed across major exchanges. Data from The Block shows that monthly spot volume reached $1.86 trillion in August, a 5% rise from July’s $1.77 trillion. Binance maintained its lead with $737.1 billion in spot trades, its highest since January, followed by Bybit with $126.5 billion and Bitget with $126.1 billion.

(Source: Exchange Volume)

This renewed activity comes alongside shifting investor preferences around the best altcoin to buy. U.S. spot Ethereum ETFs attracted $3.87 billion in August inflows, while Bitcoin ETFs saw $751.1 million in outflows during the same month.

However, this trend reversed on Tuesday as spot Bitcoin ETFs recorded $332.7 million in net inflows, led by Fidelity’s FBTC and BlackRock’s IBIT, while Ethereum ETFs saw $135 million in outflows. Analysts say this may signal a short-term rebalancing toward Bitcoin’s perceived stability, even as Ethereum retains stronger yield potential over the long term.

Meanwhile, decentralized exchanges also saw their busiest month since January, with volumes hitting $368.8 billion. Uniswap led at $143 billion, followed by PancakeSwap at $58.7 billion.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Best Altcoin to Buy Now: Eyes on Solana as SOL Price Holds Above $209

WhileBTC ▲0.71% and

ETH ▲3.46% have shown mixed signals this week, trading at $110,943 and $4,316 respectively,

SOL ▲0.89% continues to strengthen.

Since early August, SOL has made a series of higher highs, consolidating above $185 and now trading around $209. Buyers appear to be targeting the next resistance at $227.

Just flip the damn S/R and send Solana running. https://t.co/oSQmTB2otk pic.twitter.com/WZRdtQLiYE

— VikingXBT (@VikingXBT) September 3, 2025

Trading data suggests sustained demand, with buying pressure overcoming multiple attempts by sellers to stall the uptrend. This strength may reflect a rotation of capital from Ethereum to Solana, also visible on the SOL/ETH pair, where Solana has outperformed since late August.

(Source: SOL/ETH)

(Source: SOL/ETH)

For traders watching the market today, Solana’s momentum places it among the best altcoins to consider, especially if the broader trend of capital rotation continues into September.

Stay tuned to our real-time updates below.

U.S. Bancorp Relaunches Institutional Bitcoin Custody with NYDIG

U.S. Bancorp, the parent of U.S. Bank, has officially resumed its Bitcoin custody service for institutional investment managers, more than three years after pausing the program. Originally launched in 2021 alongside fintech firm NYDIG, the service was suspended in early 2022 due to stringent SEC capital requirements under Staff Accounting Bulletin 121.

With SAB 121 now rescinded earlier this year, the regulatory environment cleared, allowing U.S. Bank to reintroduce the service, now expanded to include Bitcoin exchange-traded funds (ETFs) for registered and private funds.

In this refreshed offering, NYDIG acts as the sub-custodian for the underlying BTC, while U.S. Bank maintains the client relationship.

This move positions U.S. Bancorp to compete with crypto-native custodians like Coinbase and join traditional institutions such as BNY Mellon in the growing digital asset custody landscape.

Gemini IPO Targets $317M as Trump Media Bets $1B on Crypto.com Treasury Strategy

Gemini Space Station Inc., the crypto exchange founded by Cameron and Tyler Winklevoss, has filed for a $316.7M initial public offering (IPO) in New York. Social media is dubbing it the “Gemini IPO” and the company plans to sell 16.7 million shares priced between $17–$19 each, which would give Gemini a market cap of about $2.2Bn at the top of the range.

Gemini controls more than $18Bn in assets and crypto assets, according to its filing. But the company is still losing money, reporting a $282.5M net loss on $68.6M revenue in the first six months of 2025.

The IPO will be underwritten by Goldman Sachs and Citigroup, with Gemini trading on Nasdaq under the ticker GEMI. Meanwhile, Trump is ignoring Gemini and shipping all his wealth to Crypto.com (CRONOS).

Treasury BV Raises €126M to Acquire 1,000+ Bitcoin, Plans Reverse Listing on Euronext Amsterdam

Treasury BV announced it has raised €126 million ($147 million) in a private funding round led by Winklevoss Capital and Nakamoto Holdings, enabling the company to acquire more than 1,000 bitcoin (BTC $111,568.77). The move supports its goal to become Europe’s largest publicly traded bitcoin treasury company.

As part of its public listing strategy, Treasury BV, led by CEO Khing Oei, signed a binding agreement with MKB Nedsense NV (MKBN) to execute a reverse listing on Euronext Amsterdam. The company aims to position bitcoin at the core of Europe’s financial ecosystem, a strategy Oei describes as the “equitization of bitcoin,” designed to broaden access and ownership across traditional markets.

The transaction will see MKB Nedsense transfer all assets and liabilities to its largest shareholder, Value8 NV, before issuing new shares to Treasury’s investors. The issuance price, alongside a €0.0435 dividend per share, represents a 72% premium over MKBN’s July 11 closing price and a 90% premium over the three-month average.

Following the announcement, MKBN shares jumped over 30%, trading at €0.15. Once the deal is finalized, Treasury BV is expected to trade under the ticker TRSR.

Is HBAR Price Set to Break $0.30? HBAR News and Whale Buying Set Stage For Bullish September

Recent news about HBAR whales scooping up over 50M tokens worth $11.3M in just one week. Is this accumulation bullish or just catching falling knives? Let’s find out.

From Australia’s CBDC project to White House mentions, Hedera’s credibility keeps rising. Recent launches like IDTrust and tokenization partnerships fuel real-world adoption and steady ecosystem growth.

Is Hedera chart shows a bearish setup or just bearish deviation that is going to trap retail to sell in the hands of whales. And are we going to see $0.3 mark soon?

The post Crypto News Today, September 3 – Solana Breaks $209, Outperforming BTC and ETH: Best Altcoin to Buy? appeared first on 99Bitcoins.