The process of becoming an EMI will open the way for “Careem Pay to deliver quick and accessible financial services to 9+ million consumers, 800,000 captains, and 3,000+ merchants both on and beyond the Careem App, subject to regulatory approval,” according to a release.

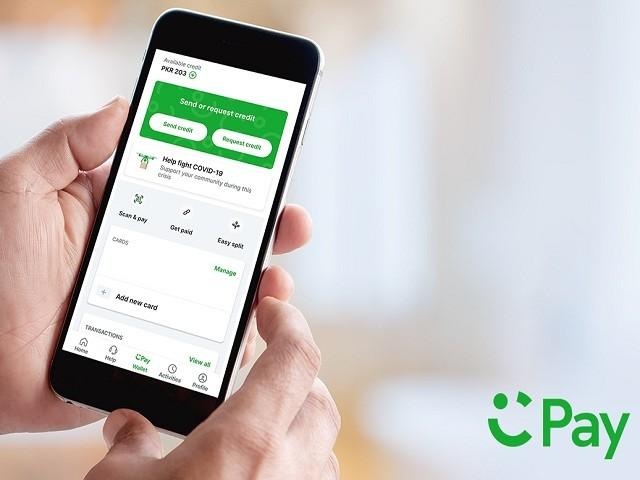

“Careem Pay aspires to provide cards, inbound international remittance services, and services that will enable Customers and merchants to make and receive online or offline payments in following phases, subject to SBP approvals,” Careem added. “This expands on Careem Pay’s existing features, which include payment across all Careem services, including ride-hailing and food delivery, as well as P2P credit transfers and mobile top-ups within the app.”

Careem Pay is the central bank’s second fintech business to get in-principle permission this year. Hubpay received in-principle permission from the SBP last month.

Only NayaPay, Finja, and China Pak Mobile have gotten approval for commercial launch, while Fintech businesses Wemsol, SadaPay, and TAG are currently in the pilot phase.

Careem, according to Noman Kurshid, is well-positioned to capitalize on Pakistan’s digital financial opportunity. “We understand the pain points and are well-positioned to develop solutions to address them because we have a large customer, captain, and merchant base across the country executing high-frequency transactions on our platform.”

“We’re pleased to contribute to Pakistan’s financial ecosystem’s digitization and financial inclusion,” he says.