Looking at the crypto market today, there’s a real excitement around the FOMC rate cut, the 25 basis points that becomes news headlines everywhere in a mostly positive way as BTC is dancing around 117K USD, ETH is just above 4.5K USD, creeping up about 0.7% in the last day, while XRP is trading close to 3.07, enjoying a 1.6% gain against. If history is any guide, similar rate cuts usually spark 20–30% gains for high-risk assets over the next few weeks. So yes, there’s cause to be mildly excited.

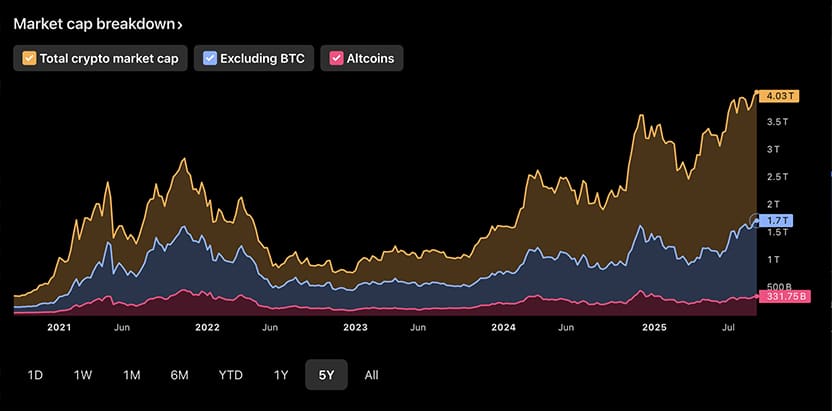

Altcoins are getting attention now that the easing has landed. Data from TradingView shows total crypto market cap rising, suggesting some capital is rotating out of BTC ▲0.49% and into high-risk plays.

(source – TradingView)

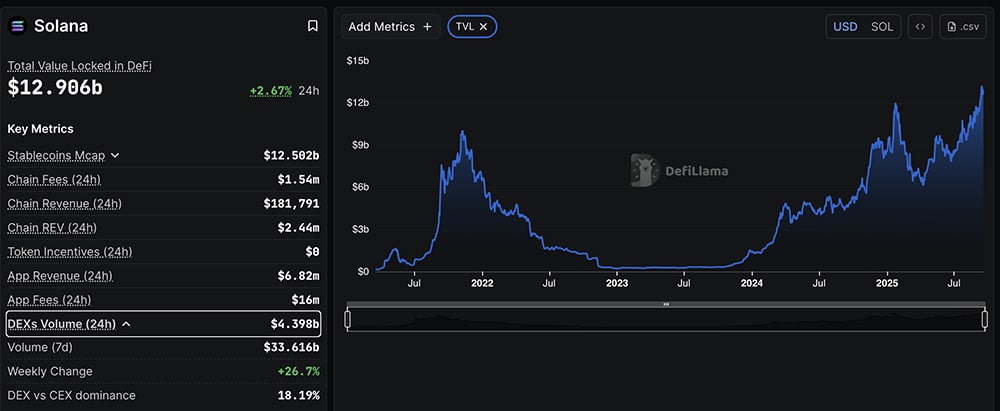

SOL ▲0.86% is up to 244 USD, gaining 3.2% today, helped by DEX volumes that climb to about $2.5B daily per DeFiLlama, a 5% jump since the cut and about 26% this week.

(source – DefiLlama)

BNB ▼-0.43%, on the other hand, is with a nice round number, at 1,000 USD, just as this article is being written. Its BSC TVL is at $7.8B, up by almost10% this week. These are the foundations of stronger sentiment across crypto.

DISCOVER: Top 20 Crypto to Buy in 2025

Today Crypto Market News Roundup: BTC, ETH, XRP Ready for Moon as Rate Cut Brings Stronger USD

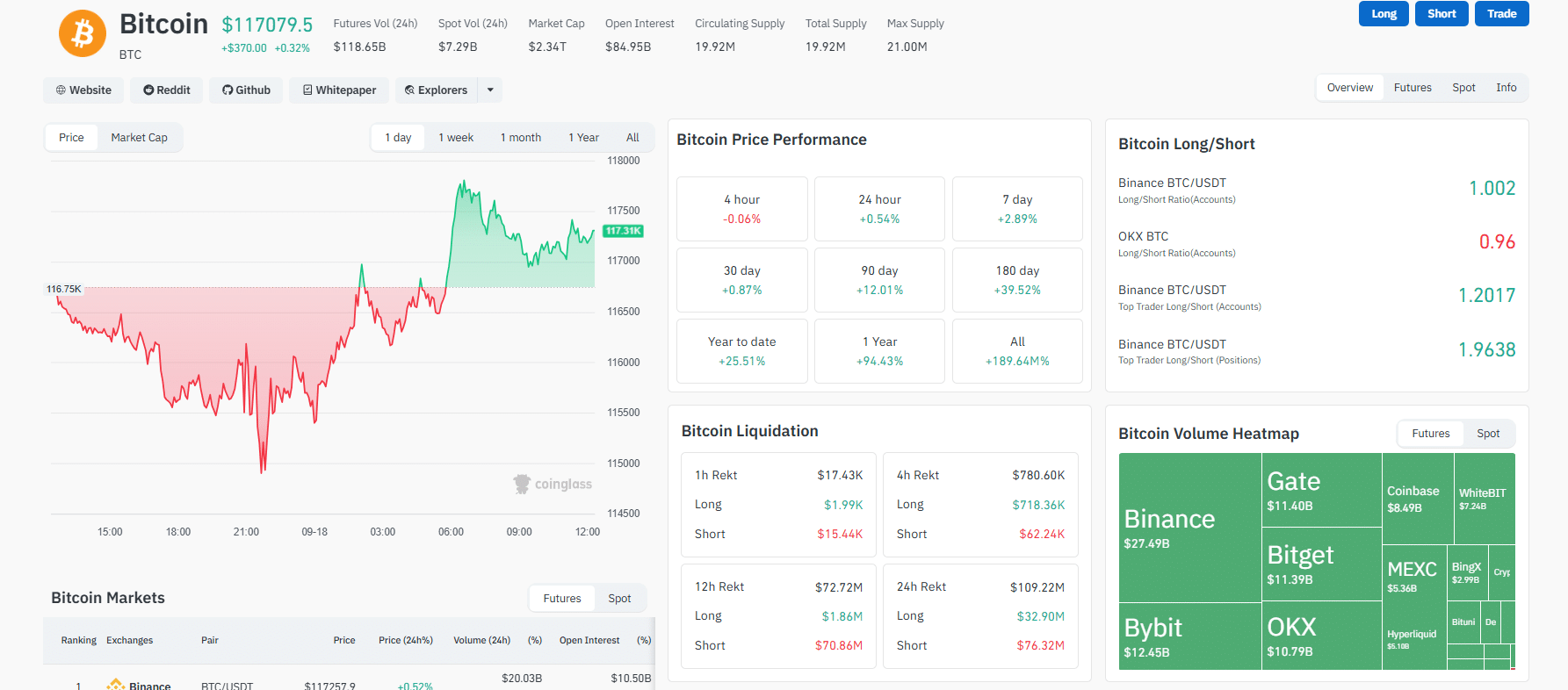

Here’s where things are headed. According to CoinGlass, open interest for BTC USD is about $85B, and long positions dominate in liquidations since the cut, a pattern we’ve seen in past ramps.

(source – CoinGlass)

ETH USD is supported by Layer‑2 TVLs (via DeFiLlama) exceeding $40B, and ETF inflows pushing over $1.2B weekly. XRP may gain institutional credibility as its CME options pick up steam with doubled volume, now around USD 15B.

Could BTC USD slip under $115,000 briefly? Sure. But with signals from the Fed hinting at perhaps two more cuts this year, bullish pressure remains. The overall DeFi total market cap is $4.2B, a huge number considering it against the traditional market.

(source – CoinGecko)

If things break well, XRP might test 3.20 USD, with BTC, ETH, and SOL leading. Optimistically, September will end on a strong note, even if there are a few dips along the way.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

With FOMC Slashing Rates, Will AAVE USD Break $400 By December 2025?

For the first time this year, the United States Federal Reserve slashed interest rates to the +4% to +4.25% range. This decision was highly anticipated and came, to some degree, from political pressure. Yet, with falling fund rates, there are high expectations that decentralized money markets, including Aave crypto, will shine. For this reason, the focus has been on AAVE USD.

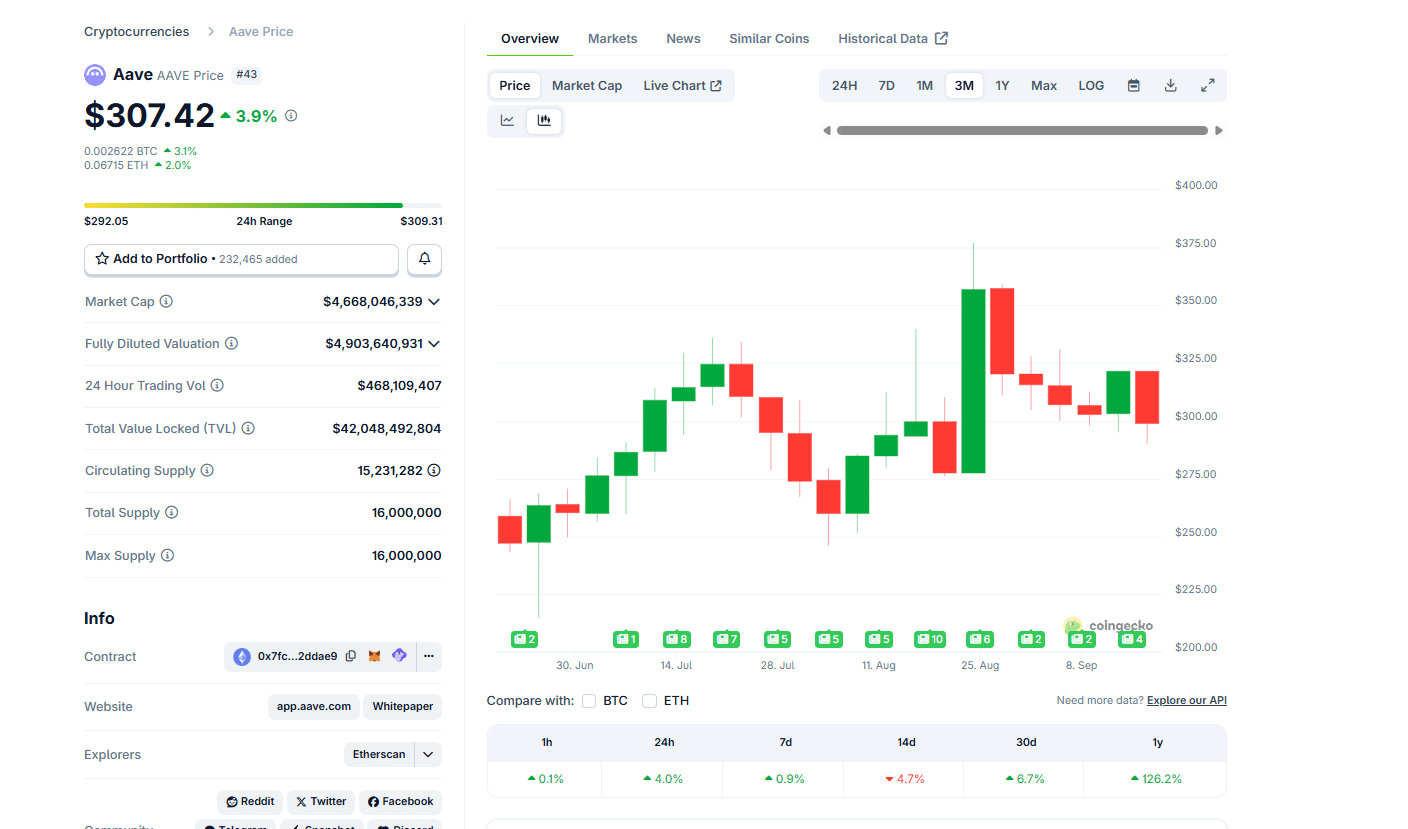

According to Coingecko, the Aave price is up +126% year-to-date and firm in the past month, adding a decent +7%. Yet, despite the optimism around crypto, with analysts painting bullish projects, including posting solid Aave price prediction posts, AAVE USDT is stable in the last week of trading, adding roughly +1%.

(Source: Coingecko)

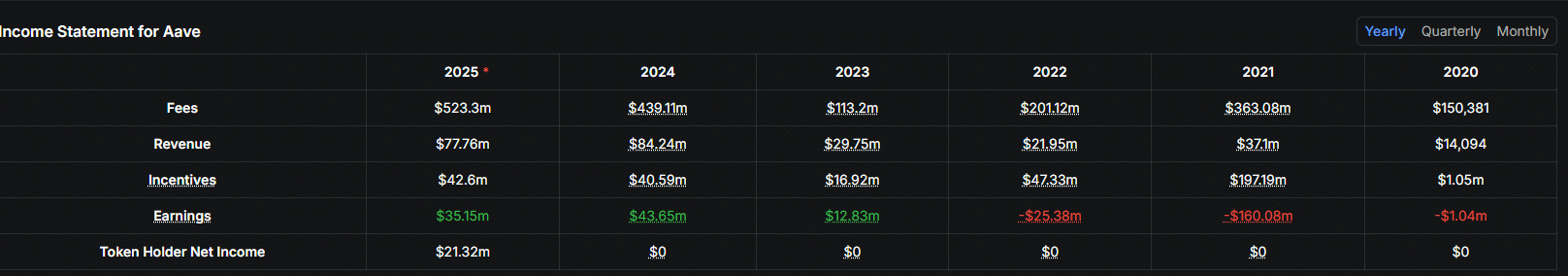

This rather slow price action is when Aave is finding massive adoption. Per DefiLlama, the decentralized money market currently manages over $42Bn. Since 2020, the Aave total value locked (TVL) has been inching higher, translating to higher platform revenue. In 2020, Aave generated just $150,000 in yearly revenue. However, by the end of 2024, this had grown to over $84M.

(Source: DefiLlama)

Read the full story here.

Will APX or Aster Crypto Be Amongst New Binance Listings?

In this post-FOMC world, BNB Smart Chain (BSC) tokens continue to dominate the crypto market. APX and Aster crypto are the latest runners, leading to speculation that one or both will be among the new Binance listings.

APX has surged by +300% overnight, while ASTER has rocketed by more than +900% since its launch yesterday. Both tokens are continuing the recent trend of BSC-based projects going parabolic, with a ‘BSC Season’ clearly upon us.

$ASTER at these prices despite being a binance official Dex coin says something.

Would be able to see em being listed on Binance spot next.

2-3$ Zone is highly possible.

Good luck if u are holding ASTER.

— Crypto King

.eth.sol (@cryptosanthoshK) September 18, 2025

Read the original story here.

TOSHI, Keycat, and MOG Crypto Blast As Meme Coins Surge +5%: Best Meme Coin to Buy?

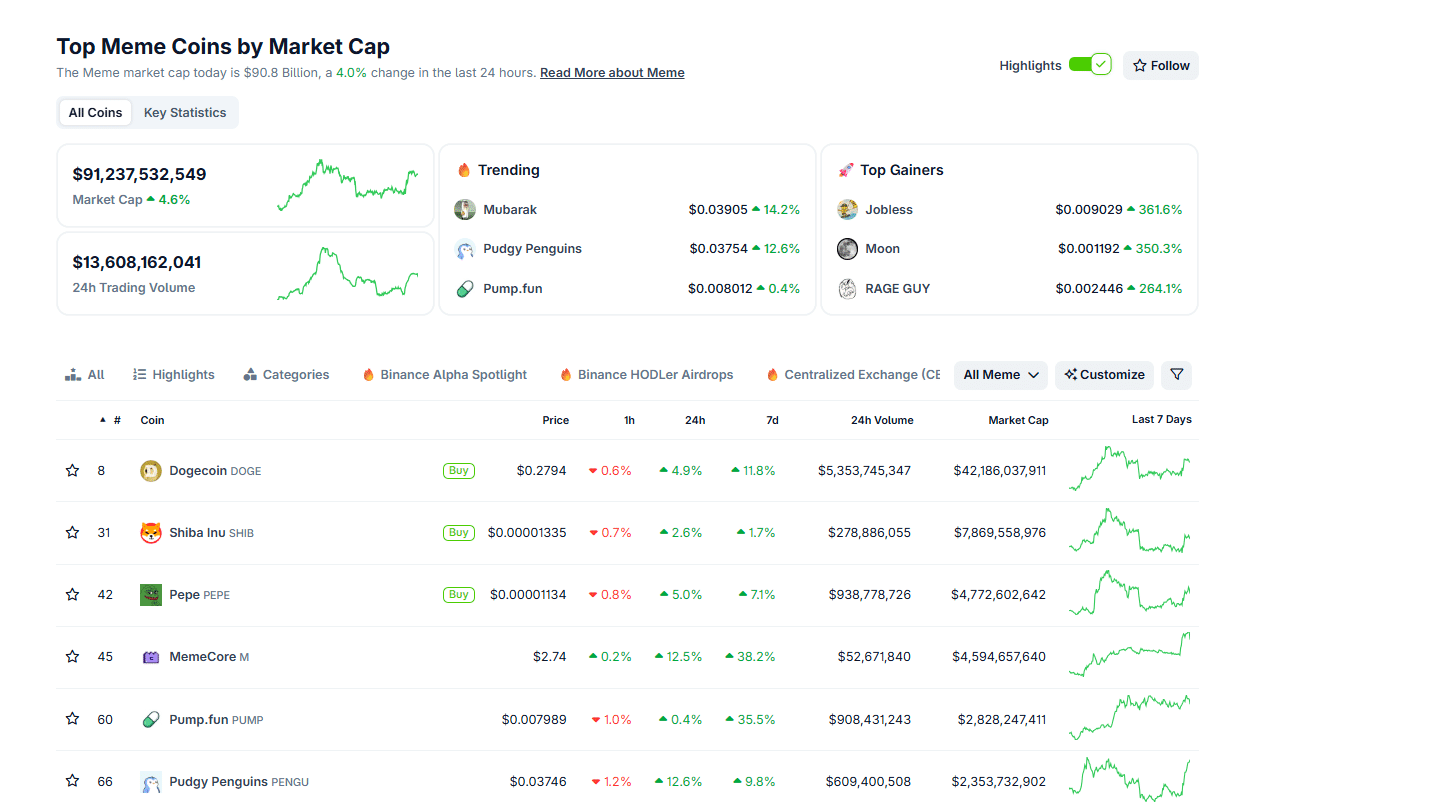

Meme coins are back in the picture, and some of the top meme coins by market cap, including Dogecoin and MemeCore, are posting impressive gains. With DOGE USD approaching key resistance levels, MemeCore slowly inching higher, and Shiba Inu likely to flip in the coming weeks or months, interest in some of the best meme coins to buy is rapidly growing.

According to Coingecko, the total meme coin market cap is up a decent +5% in the past day of trading. The uptick is mostly due to the resilience of meme coin bulls, especially those eyeing Dogecoin, MemeCore, and the resurgent PUMP crypto. DOGE USD is up nearly +12% in the past week, while M USD is up roughly +40% during that week. Meanwhile, PUMP USD is slowly inching closer to $0.01, adding +36% in the last week of trading.

(Source: Coingecko)

As top meme coins defy gravity, attention is also shifting to cat-themed meme coins. Latest market data shows that the market cap of cat-themed meme coins is up +9% to over $2.3Bn. Among the top performers are MOG, TOSHI, and KEYCAT.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Read the full story here.

FOMC Meeting: What Does the Federal Reserve’s September Rate Cut Mean for Bitcoin?

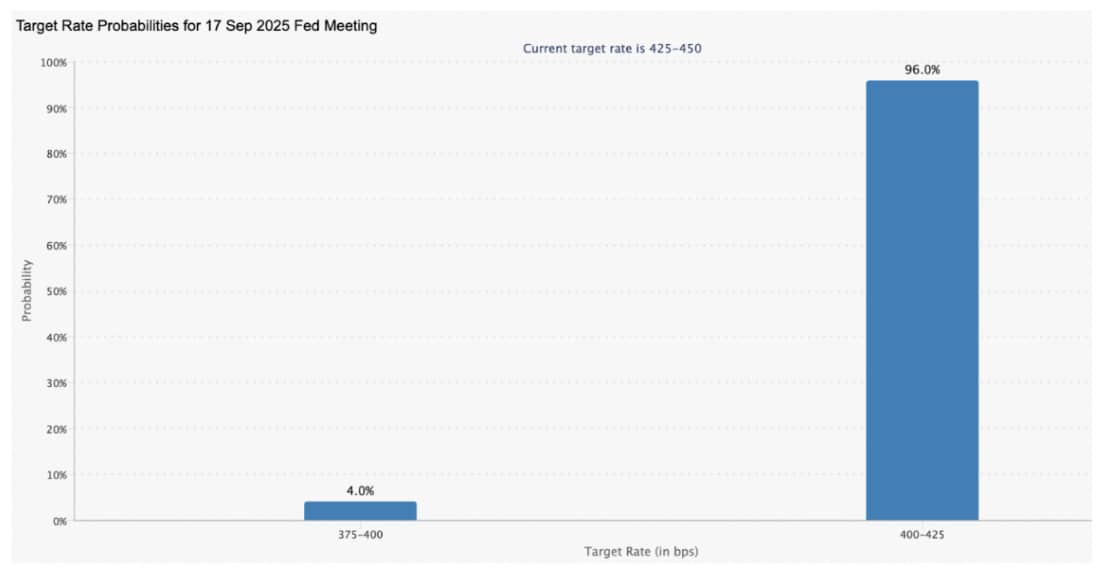

The Federal Reserve is back in focus as today’s Federal Open Market Committee (FOMC) meeting could bring the first rate cut of 2025, and traders are closely watching what it could mean for the Bitcoin price.

Markets are heavily leaning toward a rate cut at this week’s Federal Open Market Committee (FOMC) meeting.

Data from CME’s FedWatch tool shows a 96% probability that the Fed will reduce its benchmark rate by 25 basis points.

There is also a small, 4% chance that policymakers could move more aggressively, opting for a 50-basis-point cut instead.

(Source – CME Group)

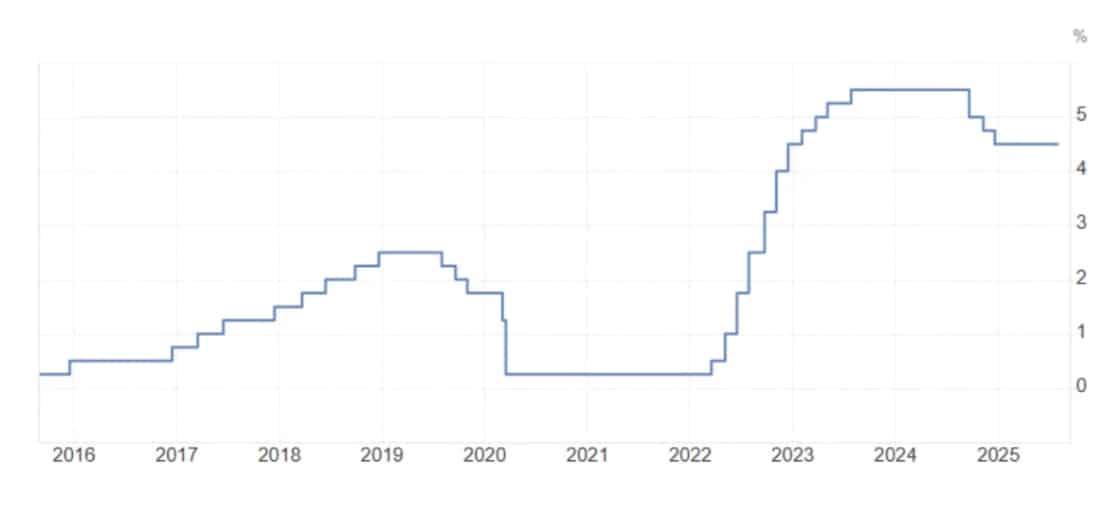

The Fed kept interest rates at 5.5% for more than a year, holding steady from July 2023 through August 2024.

Cuts began in August and ran through December, lowering the rate to 4.5%. Since then, policy has been on pause.

(Source – Trading Economics)

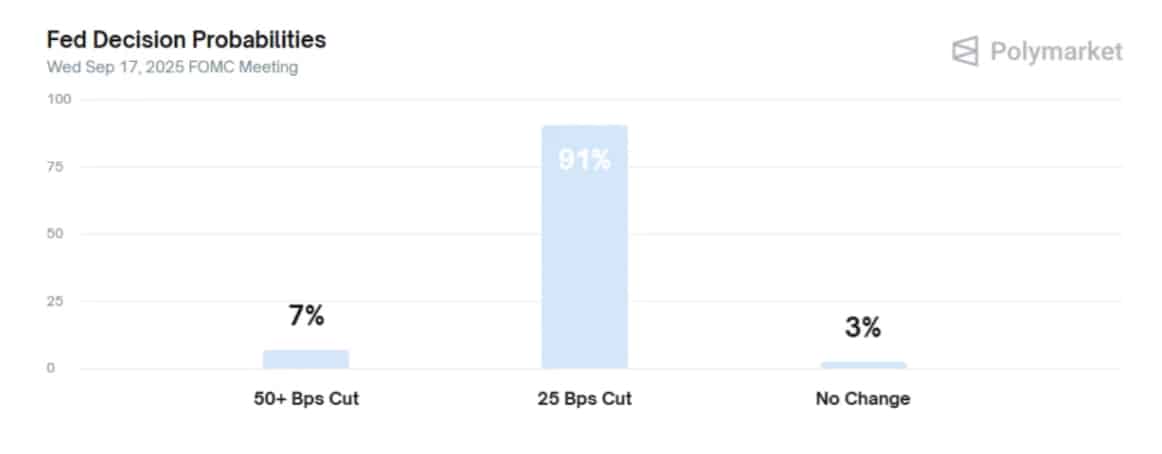

Polymarkets forecasts a 91% chance of a 0.25% cut, a 7% chance of a 0.5% cut, and only a 3% chance of no change. In other words, investors are almost certain that September will mark the Fed’s first rate adjustment of the year.

(Source – Polymarket)

Read the full article here.

BTC USD and Gold Price Trade Cautiously After FOMC Rate Decision: Best Crypto to Buy Now?

Yesterday, Jerome Powell and the FOMC officials did what every analyst and economist anticipated: Slash interest rates. However, something unexpected happened when they did. Instead of spiking above $120,000, BTC USD and most blue chips temporarily rose before dipping. At one point, the Bitcoin price trended at the $115,500 region before recovering.

The good news is that the Bitcoin price is now firm, steady above $117,000 when writing. It is also unsurprising that though BTC USD and gold are trading cautiously above key resistance levels, analysts are upbeat, expecting a moonshot. On X, one analyst is convinced the digital gold will race to as high as $155,600 in the coming weeks.

#Bitcoin is going to $155,600 ?

Price has flipped 1.618 extension level into support and is trading above it.

The next important fib level is 2.618, which is around $155,600. pic.twitter.com/SDesvZ65oj

— Mags (@thescalpingpro) September 17, 2025

On Coinglass, traders and Bitcoin holders are moderately bullish. The long/short ratio among top traders on Binance is 1.9, while the same metric among BTC account holders is 1.2. On OKX, the long/short ratio among accounts is 0.96. While traders are mostly bullish, they don’t expect an immediate takeoff, though the average trading volume across all major perpetual exchanges is rising.

(Source: Coinglass)

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Read the original piece here.

Memecore and EIGEN Price Blasts 20%: Is BTC Layer 2 Next 100X Crypto?

The hunt for the next 100x crypto intensified today as traders digested Federal Reserve Chair Jerome Powell’s 25bps rate cut, a move that has fueled bullish sentiment across risk markets. Crypto reacted almost instantly, with Memecore and EigenLayer both surging more than 20% higher in the past 24 hours, sparking a fresh wave of speculation about where smart money will next rotate.

While Bitcoin reclaimed $117K, history shows the biggest returns don’t come from BTC itself but from smaller-cap tokens building innovative ecosystems around it. With monetary policy easing and liquidity returning, traders are now asking: could a Bitcoin Layer 2 project deliver the next crypto to 100x as new capital floods into the market?

Read the full story here.

The post Latest Crypto Market News Today, September 18: FOMC Rate Cut Aftermath, BTC, ETH, XRP, and Solana Stable as BNB Close to 1K USD appeared first on 99Bitcoins.