Why is gold reaching all-time highs? The gold price has risen because investors are nervous. Political shocks, wars, and swings in monetary policy are driving people to seek instruments that maintain value when stocks and bonds fluctuate. When confidence in central banks or the dollar falls, gold often becomes the go-to “safe haven.”

For example, spot gold briefly touched the mid-$3,500s in April amid market jitters and debate over the U.S. Federal Reserve’s independence — a reminder that politics can quickly lift demand for gold.

According to the Financial Times, Tether is expanding its presence in the gold market, with plans to invest in mining, refining, trading, and royalties. The stablecoin issuer already holds about $8.7 billion worth of gold in a Zurich vault as backing for its reserves, and in June it purchased a $105 million stake in Toronto-listed Elemental Altus. CEO Paolo Ardoino described gold as “safer than any sovereign currency” and said it serves as an important complement to Bitcoin in their strategy.

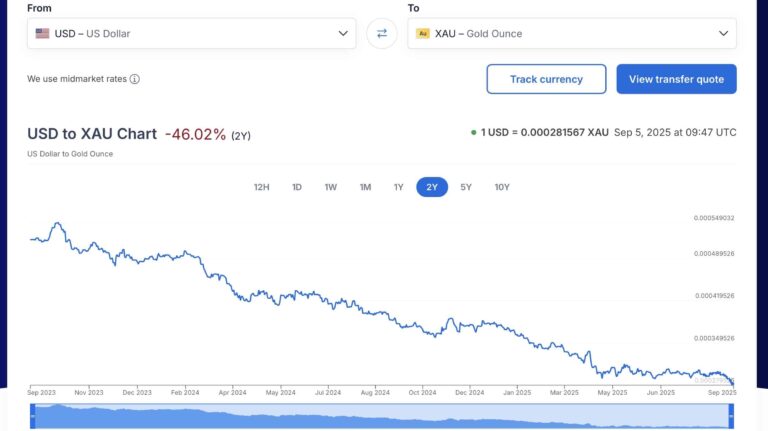

Two technical macro forces support higher gold prices. First, lower or uncertain interest rates reduce the opportunity cost of holding a non-yielding asset like gold: investors get less from bank accounts and bonds, so gold looks relatively attractive. Second, a weaker dollar raises the dollar-priced value of gold, prompting foreign buyers to purchase more metal. Taken together, rising geopolitical risk and these monetary dynamics have created a strong tailwind for gold.

(Source: USDXAU)

Gold Price Reaches New ATH, But How People Buy Gold Today: Physical, Paper, and Tokens

Basically, there are three common ways to own gold:

- Physical ownership means bars, coins, or jewellery you store yourself or place in a vault. It’s tangible and familiar, but storage, insurance, and transaction costs can eat into returns.

- The second route is financial: ETFs, futures, or gold-linked funds let you track the metal without touching it. These are liquid and easy to trade, but they are intermediated products (you rely on institutions and custodians).

- The third, increasingly popular, option is tokenized gold: blockchain tokens that represent a specific amount of physical gold held in custody. Tokenized gold aims to combine physical backing with the ease and liquidity of digital assets.

The market for tokenized gold recently topped roughly $2.57–$2.6 billion, with major tokens such as Tether’s XAUT and Paxos’ PAXG leading inflows. Tether notably minted a large batch of XAUT in August, and Paxos’ PAXG has seen strong inflows since June — signals that some investors prefer a digital route to gold right now.

(Source: Tokenized Gold)

EXPLORE: Ethereum Crypto Exchange Flux Balance Goes Negative: Will ETH USD Rally to $10K?

So, Which Option Should You Choose? Tokenized vs Physical: Pros and Cons

Tokenized gold – Pros: instant, 24/7 settlement; low minimums (you can own tiny fractions of an ounce); easy transfer across borders; and programmatic uses in DeFi (for example, using tokenized gold as collateral to borrow or earn yield). It removes the friction of buying and selling physical metal.

Cons: counterparty risk (you must trust the issuer and the custodian), regulatory uncertainty in some jurisdictions, and reliance on off-chain audits to prove that tokens are truly backed 1:1.

Physical gold – Pros: ultimate tangibility and psychological comfort; no crypto-native counterparty needed if you hold it yourself.

Cons: storage and insurance costs, slower transfers, higher transaction spreads for smaller purchases, and practical hassles when selling.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

At the end, no single approach is objectively “best” — it depends on your goals, tech comfort, and trust in custodians.

If you value custody simplicity, programmability, and lower barriers to trade, tokenized gold is an attractive and modern way to gain exposure — but only with reputable issuers (look for clear audit trails and insured vaults). If you need absolute control and want to avoid any issuer risk, physical gold stored in a secure vault or at home remains the classic choice.

Given today’s environment (high prices driven by uncertainty) many investors use a mix: a physical core for peace of mind and tokenized positions for liquidity and tactical moves.

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Gold price hits new ATH amid geopolitical risks, political shocks, and monetary policy swings.

- Investors can acquire gold physically (bars, coins), via financial instruments (ETFs, futures), or through tokenized blockchain gold.

- Tokenized gold advantages – Digital tokens offer 24/7 settlement, fractional ownership, cross-border transfers, and DeFi utility, though they carry counterparty and regulatory risks.

The post Gold Price All-Time High: Is It Better to Buy Tokenized or Physical Gold? appeared first on 99Bitcoins.