Gemini Space Station Inc., the crypto exchange founded by Cameron and Tyler Winklevoss, has filed for a $316.7M initial public offering (IPO) in New York. Social media is dubbing it the “Gemini IPO” and the company plans to sell 16.7 million shares priced between $17–$19 each, which would give Gemini a market cap of about $2.2Bn at the top of the range.

Gemini controls more than $18Bn in assets and crypto assets, according to its filing. But the company is still losing money, reporting a $282.5M net loss on $68.6M revenue in the first six months of 2025.

“We believe the U.S. market is finally ready for compliant, regulated crypto institutions,” the Winklevoss brothers wrote in their SEC filing.

Fidelity is accepting indications of interest for the Gemini IPO. $GEMI pic.twitter.com/E18FbD0pA3

— Craig Stephens | Access IPOs (@AccessIPOs) September 2, 2025

The IPO will be underwritten by Goldman Sachs and Citigroup, with Gemini trading on Nasdaq under the ticker GEMI. Meanwhile, Trump is ignoring Gemini and shipping all his wealth to Crypto.com (CRONOS).

DISCOVER: 20+ Next Crypto to Explode in 2025

Trump Media and Crypto.com Bet Big on Cronos: Why Won’t He Touch Gemini?

Donald Trump’s media empire is expanding deeper into crypto. Trump Media & Technology Group (DJT) announced a deal with Crypto.com to create a new treasury venture built around Cronos (CRO).

The company will merge with Yorkville Acquisition Corp and go public under the ticker MCGA. Trump Media will anchor its corporate reserves with $1Bn worth of CRO tokens, backed by $200M in cash, $220M in warrants, and a $5Bn equity line of credit from Yorkville affiliates. At this point, Trump is running the country like a crypto mafia don.

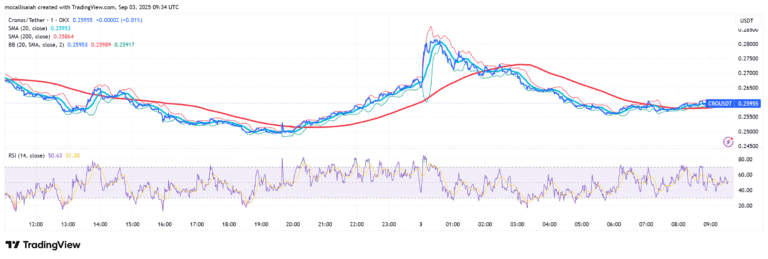

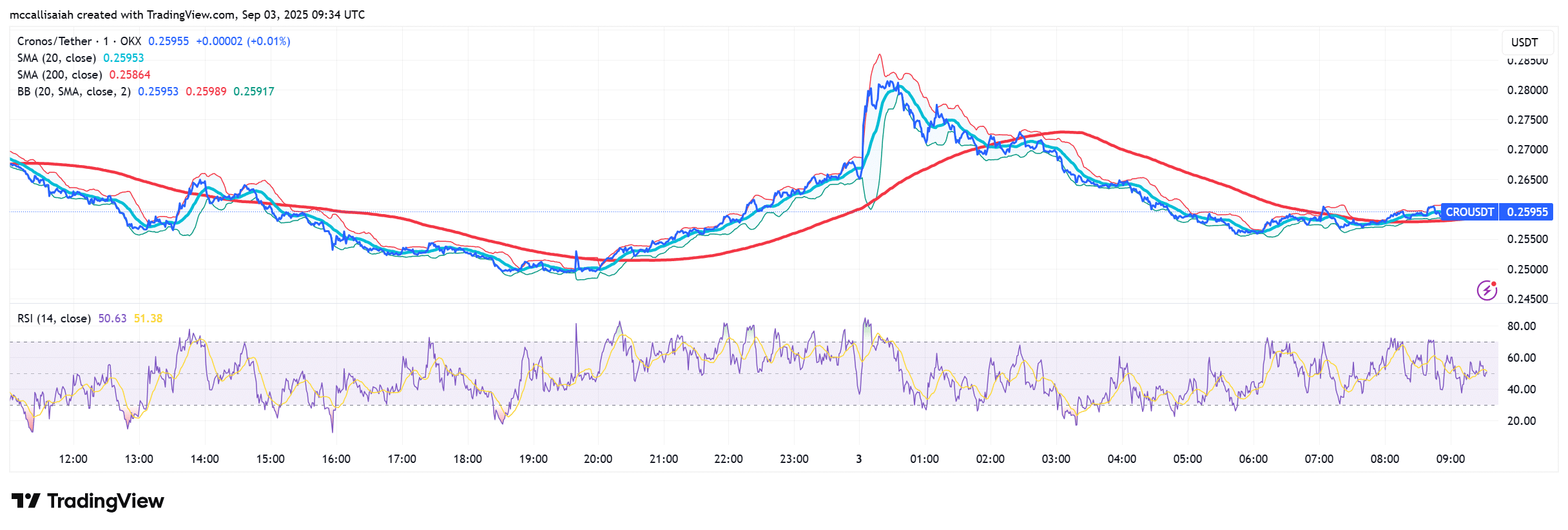

The move sent CRO up +29.6% to $0.20, according to CoinGecko, while Yorkville’s stock slid -2.2% to $10.42.

“By anchoring Truth Social’s rewards economy and corporate reserves in CRO, Trump Media is effectively institutionalizing the token,” said Alice Liu, head of research at CoinMarketCap.

Trump Media shares also rose +6.6% to $18.36, buoyed by the news.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Bitcoin Treasury Strategy Stocks You Need to Invest In

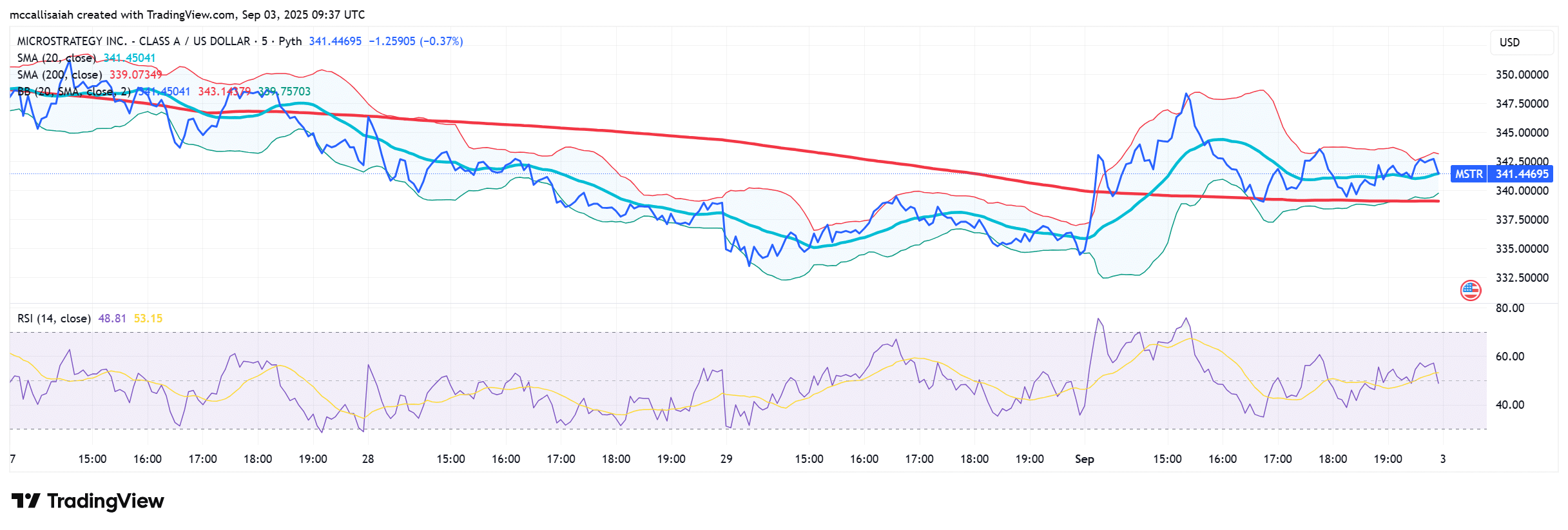

The Trump-Cronos move mirrors Michael Saylor’s playbook at MicroStrategy, which effectively transformed a software company into a Bitcoin vault now holding close to $100Bn. Investors have bought in, sending MSTR shares up fivefold alongside Bitcoin’s rally in 2024.

Corporate treasuries are testing similar waters with tokenized reserves. Circle went public in June with a $1.2Bn IPO, its stock jumping +168% on the first day.

Additionally, the SoftBank- and Tether-backed SPAC launched a $3.6Bn Bitcoin treasury firm earlier this year.

Can Gemini and Trump Media Deliver in a Crowded Market?

For Gemini, the IPO is a chance to restore confidence after past regulatory battles, including a dropped SEC case and a $5M CFTC settlement earlier this year. For Trump, well, it’s business as usual. Everything he touches turns to gold because he’s the freaking president.

Crypto.com is the latest venture, and we’ll see what else Trump pumps (and hopefully doesn’t dump like WLFI token) by year’s end.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

- Gemini seeks a $317M IPO while Trump Media launches a $1B Cronos treasury venture.

- Crypto.com is the latest venture Trump has pumped and we’ll see what else he boosts by year’s end and hopefully doesn’t dump like WLFI token.

The post Gemini IPO Targets $317M as Trump Media Bets $1B on Crypto.com Treasury Strategy appeared first on 99Bitcoins.