Is BlackRock set to become Ethereum’s Biggest Validator? ETH USD is on the verge of its next leg up after reclaiming $4,300 for the fourth time in 48 hours. A breakout from here likely takes the number two digital asset to a new all-time high, surpassing its November 2021 high of $4,878.

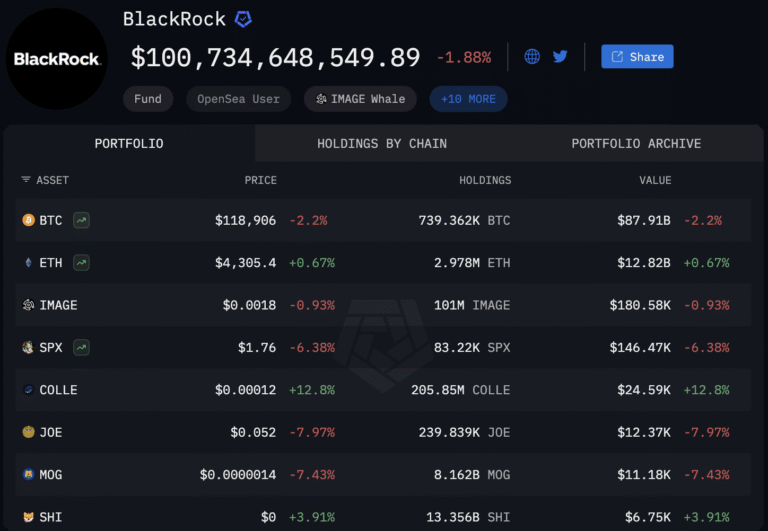

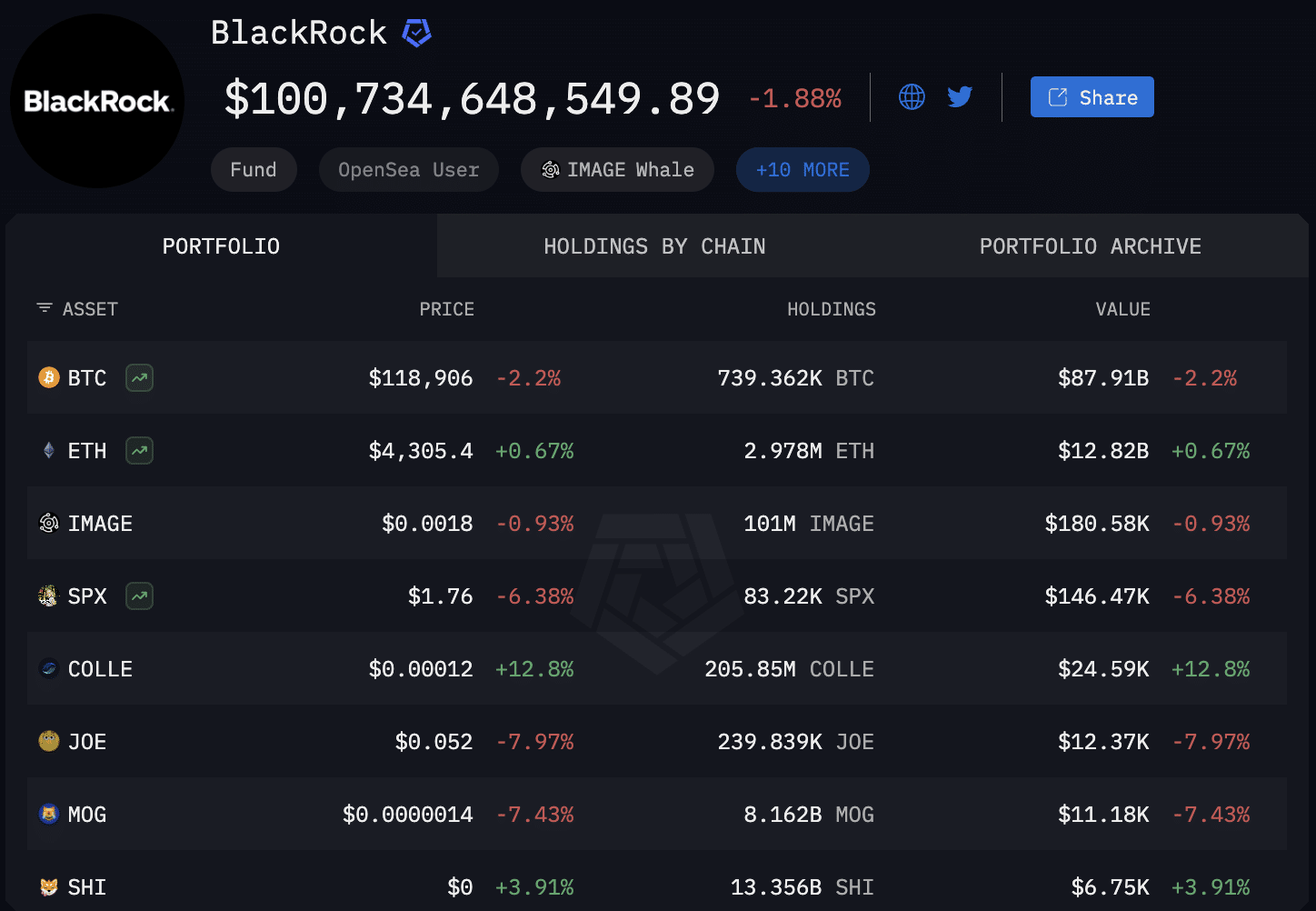

This recent price action for Ethereum coincides with BlackRock making one of its most significant ETH purchases since it began accumulating, securing 150,584.76 $ETH for $639 million, taking the asset manager’s crypto holdings over $100 billion for the first time, per Arkham.

(ARKHAM)

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

BlackRock Now Holds $12 Billion in ETH USD – What Do They Know?

With its latest nine-figure ETH USD purchase, BlackRock now holds over $12.8 billion in Ethereum, its second-largest holding behind Bitcoin ($87.91 billion).

BlackRock is the world’s largest asset manager, with over $4.74 trillion in assets under management (AUM). Per HedgeFollow, its top holding is Apple stock (AAPL), at $253.27 billion. Now, its crypto holdings have exceeded $100 billion, making it the fifth-largest holding, overtaking Meta (META), in which it holds $95.89 billion worth of stock.

It isn’t talked about nearly enough how significant it is that the world’s largest asset manager has made crypto its fifth-largest holding. And its mass accumulation of ETH, while it is still more than 11% away from its all-time high level, is telling.

For context, BTC is around 90% up from its November 2021 high of $67,617. It currently trades for $118,600 and looks ready for another leg up. BlackRock has seemingly spotted Ethereum’s undervalued position. Ethereum is the second-largest digital asset by market cap and has not yet made a new all-time high for the past four years.

With its current ETH holdings making BlackRock the largest corporate holder of Ethereum, it highlights the demand and success of its spot Ethereum ETF product. Per CoinGlass data, yesterday, $1.02 billion in positive inflows for all Ethereum ETFs were seen, with over $639 million of that coming from BlackRock’s ETHA ETF.

BlackRock is now seeking approval from the SEC to allow staking of its ETH holdings. If passed, this could see the asset manager earning over 209 ETH in yield on its Ethereum holdings per day, which equates to around $867,000 in daily ETH USD rewards, a staggering amount for BlackRock and its ETHA investors.

Blackrock bought $12,065,478,744 $ETH.

You might want to check how much Ethereum you’re holding.

Don’t be left underexposed. pic.twitter.com/pkM7EYcStS

— Ted (@TedPillows) August 11, 2025

DISCOVER: Top Solana Meme Coins to Buy in August

Could BlackRock and Ethereum Treasury Firms Be the Catalyst to Send Ethereum to $15k?

Not only is BlackRock buying ETH in huge quantities, but publicly traded companies are also taking the Michael Saylor/Strategy approach and pivoting to Ethereum Treasury firms.

Sharplink Gaming (SBET), headed by Ethereum co-founder Joe Lubin, and Bitmine (BMNR), a former Bitcoin mining firm led by Tom Lee, are the two most prominent. Both firms now hold a combined 1.67 million ETH and are still buying.

The difference between a Bitcoin Treasury strategy and an Ethereum one is the yield on offer with ETH staking. The current APR is around 2.6% on average, meaning these firms can earn sizeable interest just for staking Ethereum.

This opens up the possibility for it being a more lucrative venture than the same strategy with Bitcoin due to the yield on offer. And with ETH USD still being under its 2021 all-time high, the continuous buying of Ethereum from behemoths such as BlackRock and the other asset managers, and also the ETH Treasury firms such as Sharplink and Bitmine, make the possibility of Ethereum hitting $10,000+ this cycle a real possibility.

Retail investors can now invest in Ethereum without needing to navigate crypto exchanges, their awkward UIs, and unforgiving processes. By simply investing in BlackRock’s ETHA fund or buying SBET/BMNR stock, investors can gain exposure to the Ethereum upside more easily than ever.

Then, if you add in to the mix that the chance of a 25bps rate cut in September at the Federal Reserve FOMC meetings is sitting at a 73% chance of ‘YES’ on prediction platform, Polymarket, things are shaping up for ETH USD to skyrocket to five-figures in 2025.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Is BlackRock Set To Become Ethereum’s Biggest Validator? Here’s How ETH USD Can Hit $15K appeared first on 99Bitcoins.