Liquid staking is a core part of crypto, especially proof-of-stake ecosystems, including Ethereum and Solana. Because community members must run nodes and “stake” or “lock up” assets to secure the network, their involvement is necessary for its security. The more participants, the more resilient the blockchain is against attacks from malicious third parties.

Therefore, on August 5, when the United States Securities and Exchange Commission (SEC) issued new guidance suggesting that certain liquid staking activities won’t fall under its regulatory purview, the excitement in the liquid staking market was palpable.

Even though non-binding, this guidance was seen as a major step towards the United States, especially SEC officials, embracing crypto innovation. However, while it is transformative, not everyone is supportive.

SEC Commissioner Caroline Crenshaw is critiquing the validity of this guidance, thereby casting a shadow over hopes of liquid staking integration into spot Ethereum ETFs and similar products tracking networks like Solana, that depend on liquid staking providers for extra security.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The SEC’s Position on Liquid Staking

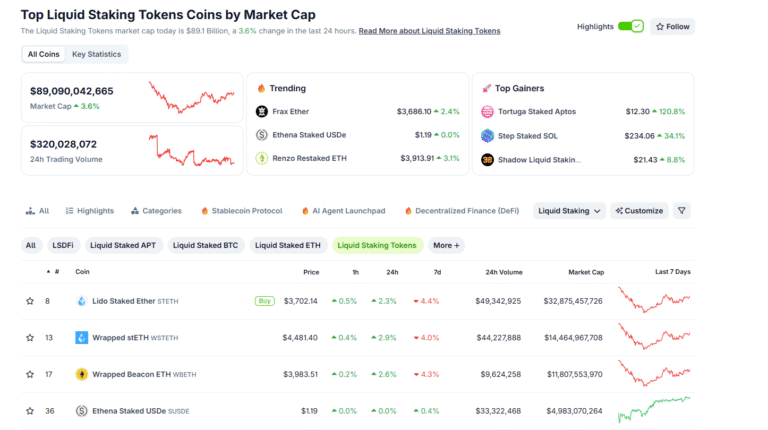

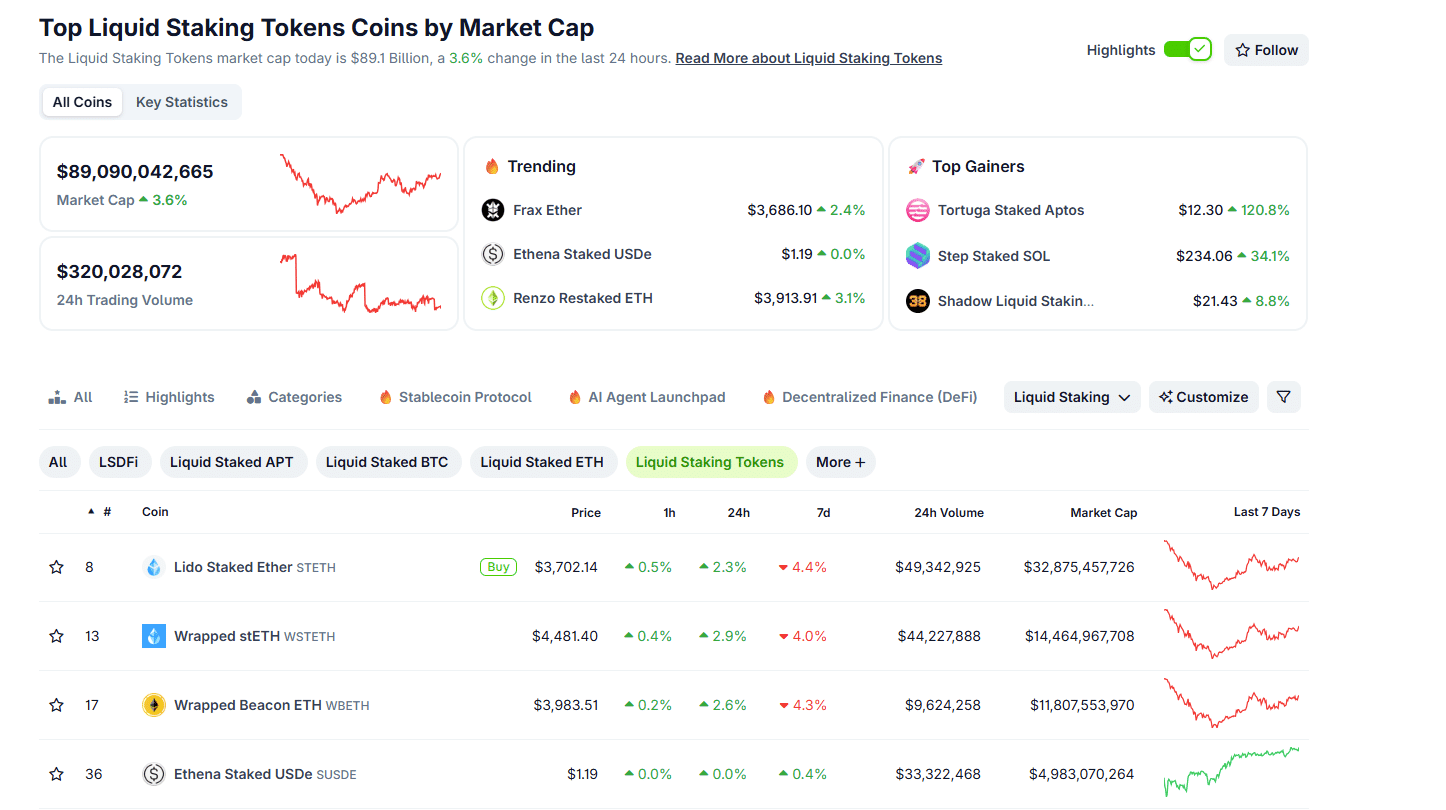

Liquid staking is a cornerstone of crypto, especially DeFi. According to Coingecko, the industry now commands over $89 billion in total value locked (TVL), exceeding the market cap of the top Solana meme coins.

Under liquid staking, crypto holders can stake their assets like ETH and SOL via providers like Lido Finance, Marinade Finance, or even Rocket Pool while receiving liquid tokens representing their staked assets.

These liquid staking tokens (LSTs) can be traded or used in other DeFi protocols, offering flexibility, all while ensuring the staker doesn’t fail to secure the underlying network.

Historically, especially under Gary Gensler, the SEC has been stringent, arguing that many staking programs, including liquid staking, resemble the offering of investment contracts under the Howey Test. They compared staking and liquid staking activities as securities offerings since stakers expected profits from the efforts of others.

Accordingly, this perspective led to enforcement actions, which saw Kraken shut down its staking program in the United States. There was also scrutiny for many providers offering staking-as-a-service.

On August 5, the SEC, through the Division of Corporation Finance, released a non-binding guidance that changed their position. They said that certain liquid staking arrangements, especially if the token in question powers a truly decentralized network, don’t necessarily meet the criteria set by the Howey Test, and thus are not securities offerings.

Paul Atkins, the SEC chair, added that this guidance, though not a formal rule and doesn’t carry legal weight beyond staff interpretation, was a “significant step” towards regulatory clarity in crypto.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Crenshaw’s Dissent: A Regulatory Reality Check

Since the guidance is open to diverse interpretation, Commissioner Caroline Crenshaw issued a scathing dissent, saying it heavily relied on unsupported assumptions, especially on the structure of the liquid staking program.

She argued that the guidance fails to reflect the complex realities of the DeFi ecosystem, warning that since it is also non-binding in nature, it offers little protection for platforms and entities involved in liquid staking. Accordingly, given her stance, it may appear that liquid staking programs may still be engaged in the illegal offering of unregistered securities.

Crenshaw warns those engaged in liquid staking activities to proceed cautiously and that the guidance might not “reflect prevailing conditions on the ground.”

“Given its unsupported factual assumptions and circumscribed legal analysis, the Liquid Staking Statement should provide little comfort to entities engaged in liquid staking, especially since, as the statement rightly notes, it only “represents the views of the staff of the Division of Corporation Finance,” not the views of this or any future Commission.”

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Implications for Spot Ethereum ETF Issuers

Her philosophical position puts her at odds with Atkins, who advocates for lighter regulations in crypto to boost innovation and the flow of capital to some of the best meme coin ICOs. This may also be a blow for spot Ethereum ETF issuers, who were confident the SEC would permit them to stake underlying share collateral and earn a yield.

When the SEC approved spot Ethereum ETFs in 2024, it excluded staking features. Their concerns were that staking would effectively classify these ETFs as securities now that issuers would generate passive income. This was different from spot Bitcoin ETFs because Bitcoin doesn’t support staking.

The SEC guidance raises hopes that Grayscale, BlackRock, and other spot Ethereum ETF issuers could integrate liquid staking into ETFs without triggering securities laws in the United States. Doing so will align with global trends, as countries like Canada and regions like Hong Kong support approved crypto ETFs with staking components.

Crenshaw’s dissent, given the guidance’s non-binding authority, dashes these hopes. Her warning implies that the regulator could still pursue enforcement actions against spot Ethereum ETF issuers in the United States should they integrate liquid staking programs. For now, issuers would have to wait, aware that they cannot rely on this guidance without more legal advice from the SEC.

DISCOVER: 20+ Next Crypto to Explode in 2025

SEC Commissioner Critiques Liquid Staking, No Hope for ETF Staking?

- Liquid staking is a core part of proof-of-stake systems

- SEC issued guidance supporting certain liquid staking programs

- Caroline Crenshaw opposes the SEC’s guidance on liquid staking

- Delays expected before spot Ethereum ETF issuers integrate liquid staking

The post Did the SEC Just Back Down on Liquid Staking: SEC Commissioner Shuts Down Staking ETF Hopes appeared first on 99Bitcoins.