The nuclear industry is in the mist of a renaissance. Old plants are being refurbished, and investors are showering startups with cash. In the last several weeks of 2025 alone, nuclear startups raised $1.1 billion, largely on investor optimism that smaller nuclear reactors will succeed where the broader industry has recently stumbled.

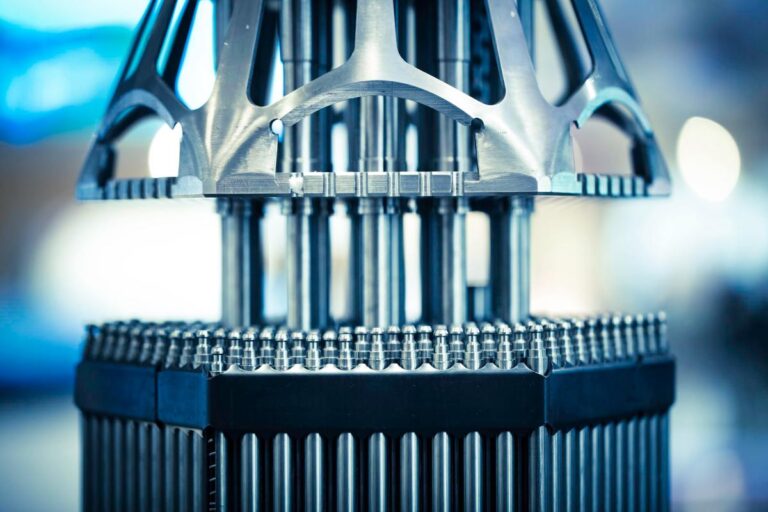

Traditional nuclear reactors are massive pieces of infrastructure. The newest reactors built in the U.S. — Vogtle 3 and 4 in Georgia — contain tens of thousands of tons of concrete, are powered by fuel assemblies 14 feet tall, and generate over 1 gigawatt of electricity each. But they were also eight years late and more than $20 billion over budget.

The fresh crop of nuclear startups hopes that by shrinking the reactor, they’ll be able to sidestep both problems. Need more power? Just add more reactors. Smaller reactors, they argue, can be built using mass production techniques, and as companies produce more parts, they should get better at making them, which should drive down costs.

The magnitude of that benefit is something experts are still researching, but today’s nuclear startups are depending on it being greater than zero.

But manufacturing isn’t easy. Just look at Tesla’s experience: The company struggled mightily to profitably produce the Model 3 in large numbers — and it had the benefit of being in the automotive industry, where the U.S. still has significant expertise. U.S. nuclear startups don’t have that advantage.

“I have a number of friends who work in supply chain for nuclear, and they can rattle off like five to ten materials that we just don’t make in the United States,” Milo Werner, general partner at DCVC, told TechCrunch. “We have to buy them overseas. We’ve forgotten how to make them.”

Werner knows a thing or two about manufacturing. Before becoming an investor, she worked at Tesla leading new product introduction, and before that, she did the same at FitBit, launching four factories in China for the wearables company. Today, in addition to investing at DCVC, Werner has co-founded the NextGen Industry Group, which works to advance the adoption of new technologies in the manufacturing sector.

Techcrunch event

San Francisco

|

October 13-15, 2026

When companies of any size want to manufacture something, they face two main challenges, Werner said. One is capital, which is often the biggest constraint since factories aren’t cheap. Fortunately for the nuclear industry, that shouldn’t pose much of a problem. “They’re awash in capital right now,” she said.

But the nuclear industry isn’t immune from the other challenge all manufacturers face, which is a lack of human capital. “We haven’t really built any industrial facilities in 40 years in the United States,” Werner said. As a result, we’ve lost the muscle memory. “It’s like we’ve been sitting on the couch watching TV for 10 years and then getting up and trying to run a marathon the next day. It’s not good.”

After decades of offshoring, the U.S. lacks people experienced with both factory construction and operations. “There are for sure some people in the United States who have been doing this, but we don’t have the quantum of people that we need for everybody to have a full staff of seasoned manufacturing people.” She not just talking about machine operators, but everyone from factory floor supervisors all the way up to CFOs and board members.

The good news is that Werner sees a lot of startups, nuclear and otherwise, building early versions of their products in close proximity to their technical team. “That is pulling manufacturing in closer to the United States because it allows them to have that cycle of improvement.”

To reap the benefits of mass manufacturing, it’s helpful for startups of all stripes to start small and scale up. “Really leaning into modularity is very important for investors,” she said. The modular approach helps companies start producing small volumes early on so they can collect data on the manufacturing process. Ideally, that data will show improvement over time, which can put investors at ease.

The benefits of mass manufacturing don’t happen overnight. Companies will often forecast cost reductions that can result from learning through manufacturing, but it might take longer than they expect. “Often it takes years, like a decade, to get there,” Werner said.